2x 3x Analysis:

For fluctuation trading, it is preferable to have a security (stock/bond/commodity/currency etc.) that fluctuates widely, rather than securities for which the prices have little fluctuation. Wide fluctuations often times result in faster trades, and quicker profit. Let me give example that will elaborate on this.

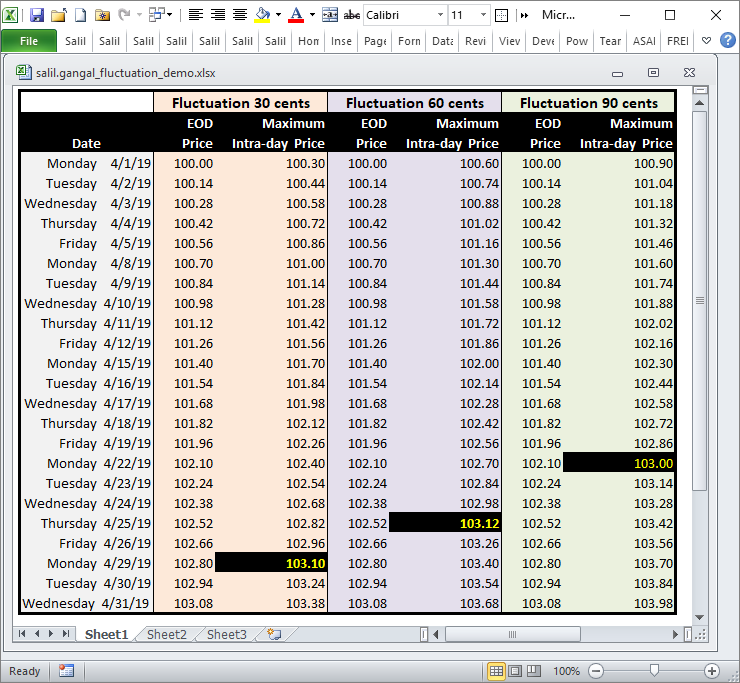

Say there's a stock that starts trading at $100.00, and the flucuation is 30 cents per day on the upside.

Say there's another stock that starts trading at $100.00, and the flucuation is 60 cents per day on the upside.

Say there's yet another stock that starts trading at $100.00, and the flucuation is 90 cents per day on the upside.

Also let us say that all of these stocks over 1 month have gone from starting $100.00 to $103.08 with daily rise of 14 cents each.

The following table will show that if I were to start on 4/1, then

it will take till 4/29 to get 3% gain with stock that has 30 cents fluctuation on the upside.

it will take till 4/25 to get 3% gain with stock that has 60 cents fluctuation on the upside.

it will take till 4/22 to get 3% gain with stock that has 90 cents fluctuation on the upside.

In conclusion, the stock with higher flucuation in this example has resulted in faster trade giving quicker profit, evenif each of them have idential performance as measured from 4/1/19 thru 4/31/19 on the EOD basis.

There are ETFs/ETNs available that are leaveraged to achieve double (2x) the performance of a particular index/benchmark both on upside and downside. And then there are some that are leaveraged to achieve negative-double (-2x) the performance of a particular index/benchmark both on upside and downside. Then there are some that will do thrice (3x) and negative-thrice (-3x). There are ETFs that closely track the famous Index 'S&P 500' (e.g. SPY, IVV, VOO). These ETFS go up by nearly 1% if 'S&P 500' index rises by 1%, similarly these ETFs fall by nearly equal percent if 'S&P 500' index falls.

There are ETFs such as SSO and SPUU that track 'S&P 500' with a 2x leaverage. Which means that if 'S&P 500' rises by 1%, then SSO and SPUU will rise approximately by 2%. Similarly if 'S&P 500' falls by 1% then SSO and SPUU will fall by spproximately 2%.

Likewise there is ETF such as SDS that is leaveraged by negative 2x (i.e. -2x). And the there are even 3x ETFs such as SPXL and UPRO, and -3x ETFs such as SPXS and SPXU.

Trading such 2x, -2x, 3x, and -3x ETFs/ETNs potentially can give faster trades, and quicker profits. (It is important to bear in mind that the losses also will be fasters/quicker with such leaveraged ETFs/ETNs.) I use Technical Analysis to trade such 2x/3x ETFs/ETNs often enough, to generate quicker profits, when the financial markets are going up, and when they are going down as well! In the sample screen-grab I've given below, the analysis I perform for the 2x,3x,-2x,-3x ETFs/ETNs is presented.

I use End-Of-Day data to generate Technical Analysis files. The data-vendor I use for getting the EOD data is TC200 (aka Worden Brothers), and the charting package I use is Amibroker. I've coded the analysis using AFL (Amibroker Formula Language) and C# (Free language by Microsoft). The final actionable result is generated using the analysis data generated using AFL/C# in Excel with some coding in VBA. I'm giving below a screen-grab of final analysis I generate daily to place the trades.

Actually, the technology details I gave in earlier paragraph are of secondary nature, and are just describing the decision support system I've built. The primary focus, of course, is the intelligence that's generated to help me with the decision making.

Decision being buy or wait. Most of the times, for most of the ETFs, the decision is 'wait' *smile* - means just keep watching the movement of ETFs for the next day, and the next, and the next ... However for some of the times the indicators help me arrive at the 'action' desicion. This is when I act to Buy.

2x 3x Analysis I do, spans acrosss almost all of the leaveraged ETFs/ETNs that are available on US Exchange. I use the following Technical Indicators to generate signals:

(1) Commodity Channel Index (CCI-19) (2) Rate of Change (ROC-15) (3) Momentum (MO-5) (4) Chande Momentum Oscillator (CMO-13) (5) Lows Signal

I avoid the ETFs/ETNs that are thinly traded. I measure the volume for each, and rank them with following ranks.

(1) Poor (2) Fair (3) Nice (4) Good

The overall analysis of the Technical Indicators and volume results in the actionable intelligence of score and signal.

As the sample below shows, there are a few ETFs/ETNs for which the algorithm has give a "Buy" signal. Some of these have 'Poor' volume (e.g. RWED, YCS) means both very thinly traded, with large spread between bit and ask. Some have 'Good' volume, (e.g. EDC, KORU, YINN, TECL) means these have good market, many traders are willing to buy-n-sell. I already have bought these. Actually for TECL, I have bought-n-sold in last couple of days 5/9/2019 BUY followed by 5/10/2019 SELL giving faster trade. Majority of others are all are signalling 'Wait' !! As I've indicated, for most of the ETFs/ETNs, for most of the times I keep waiting *smile* for what I perceive as a favorable opportunity. When such as opportunity is revealed, via the algorithmic decision support system I've built, I act.

|