Profit making trading systems:

The most simplistic objective, for every trading system with the intent of profit making, is to buy low sell high. (There are some trading systems where the intent isn't profit making, rather it's 'tax-loss harvesting'. For such systems the simplistic objective does not apply.) Tactics to achieve 'buy-low-sell-high' in a cosistent manner involves using sophisticated algorithms. The algorithms that give consistent overall profits in all market conditions. During recession and expansion - in bull market and in bear market - during periods of inflation/deflation/stagflation, are esential for a successful trader.. To achieve this, I've designed sophisticated trading systems. (a) Fluctuation Trading (b) Wave Trading (c) Blitz Trading.

All of these systems are my 'original' work. I retain the copyright of this intellectual property, however, I am permitting others to make use of the algorithms. For my original work, I've coined terms for each of these trading systems.

I've alluded to this  in the web-page in the web-page  . .

Blitz Trading:

I've designed this system for Exchange Traded Funds - especially for commission-free ETFs. This system tends to have a very large number of trades in a year (typically thousands), therefore I use this sysem for tax deferred accounts (e.g. IRA, 401(k), Rollover IRA). Because of the very large number of trades, this trading system is ideally suited where the trading comissions are low. With the advent of 'commission Free' trades available at various brokerages (e.g. First Trade, TD Ameritrade, Fidelity, Alpaca) commission charges have become a non-issue. (Using this system where there are high commissions could be detrimental.)

Employing this system for taxable account is of course doable, however the Form 1099-B in case of thousands of trade in a year will be very very long. Entering these trades in Schedule D, and tracking the 'wash' sales, if any, will be an onerous task. Therefore, I do not use this system for taxable accounts at all. I've signed-up for eDelivery of all trade-confirmation letters from my brokers, otherwise USPS delivery of vast number of trade confirmations letters would fill-up my mail-box.

Lately I've started using this system in Taxable accounts as well. To comply with the 'Wash Sale' of IRS, I only trade a specific set of ETFs in Taxable Account, which I exclude from trading in tax-deferred accounts. This sort of mutually exclusive sets of ETFs for taxable/tax-deferred accounts makes tracking of 'Wash Sales' trades easy/manageable. (In my day-job, I'm a SOX Analyst, therefore 100% compliance with the SOX Act - and in this case Wash Sale Rule is something that's always at the top of my mind.)

The term Blitz originates from a German word. It means a flash of lightning. It also means high speed. This trading system is a speedy system. It generates rapid trades. That's the reason I coined the term Blitz Trading, for this system.

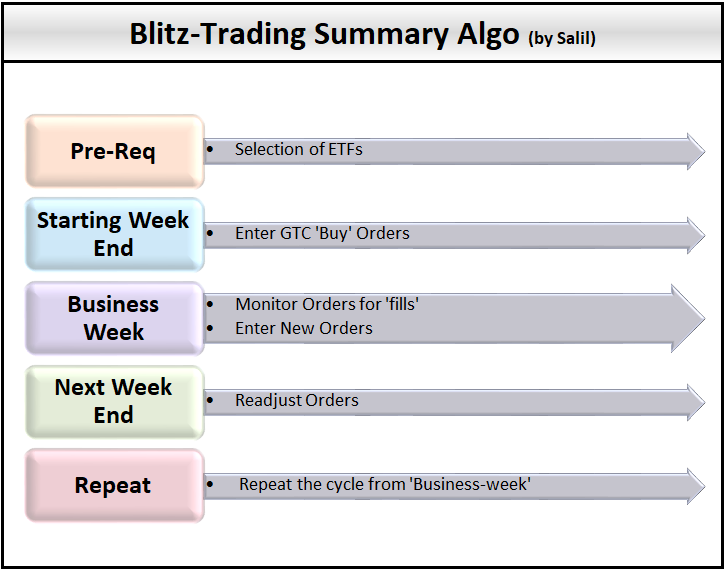

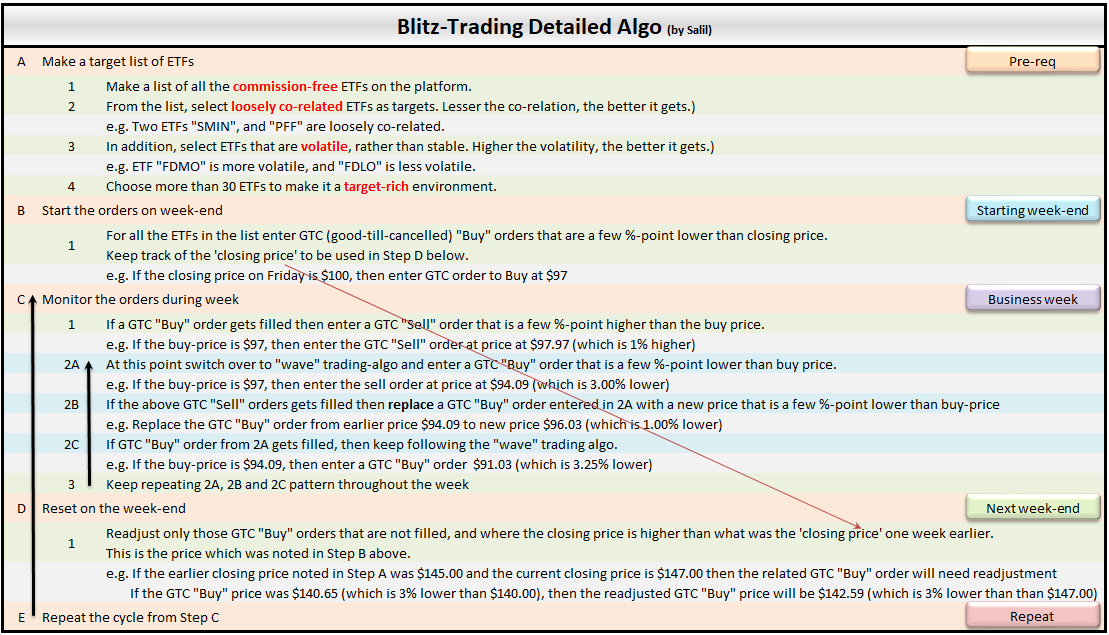

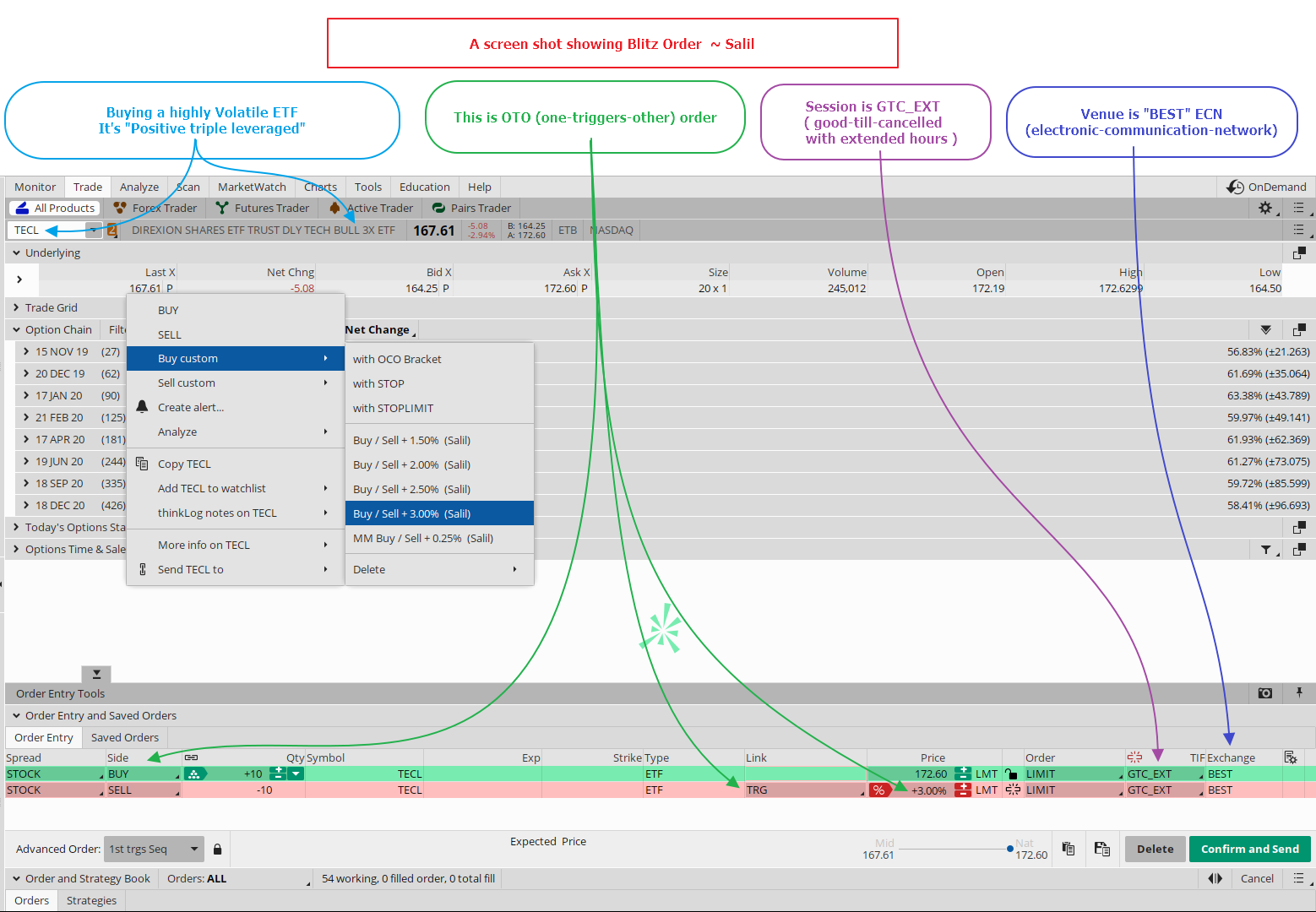

Blitz Trading Algo:

Blitz Trading: Sample:

Blitz Trading: Additional Triggers:

In the algorithm I've given above, the initiation is done via the calendar-driven approach where the orders are is based on Week-end/Business-week/Week-end. In addition to the calendar, the initiation of the algo is also driven by an emergence of favorable chart pattern.

Favorable chart pattern is perceived using the chart. It's the pattern that the Price/NAV of the ETFs/MFs make alongwith the various technical indicators. I have a few favorite technical indicators - mostly Oscillators - which I use to initiate the algo. e.g. Commodity Channel Index (CCI), Chande Moementum Osciallaor (CMO), Price Zone Oscillator (PZO), Rate-of-change (ROC).

Once the algo is triggered via 'favorable-chart-pattern' the loop c. Monitor the orders during week is executed.

I've implemented majority of this algorithm using Python (Pandas, MatPlotLib, Request). The advantage of automation is that the algo is omnipresent. It's impractical for me (personally) to enter/cancel/accommodate 1000s of orders/trades manually, and it's impractical for me (personally) to keep-on monitoring 1000s of ETFs/MFs every day manually. Full/partial automation allows the 'algo' to take over the part that's quite impractical for me, as a human, to keep pefroming manually. I need time to sleep, to do daily chores, to do a day-job, but the automated algo needs none of this. In addition, when the markets are doing their upswings/downswings, then I would likely given-in to my emotions/adrenalin when I would encounter panic/euphoria, and execute some trades, that are not necessarily driven by logic, but are triggered by my emotions/adrenalin, if I am watching the markets.

(That's why I don't watch markets intra-day carefully - I just glance at the markets.)

However, the automated+omnipresent algo watches the market, and executes trades dispassionately, without emotions !! It acts exactly in accordance with the logic I've implemented, and within the parameters I've set - nothing more / nothing less.

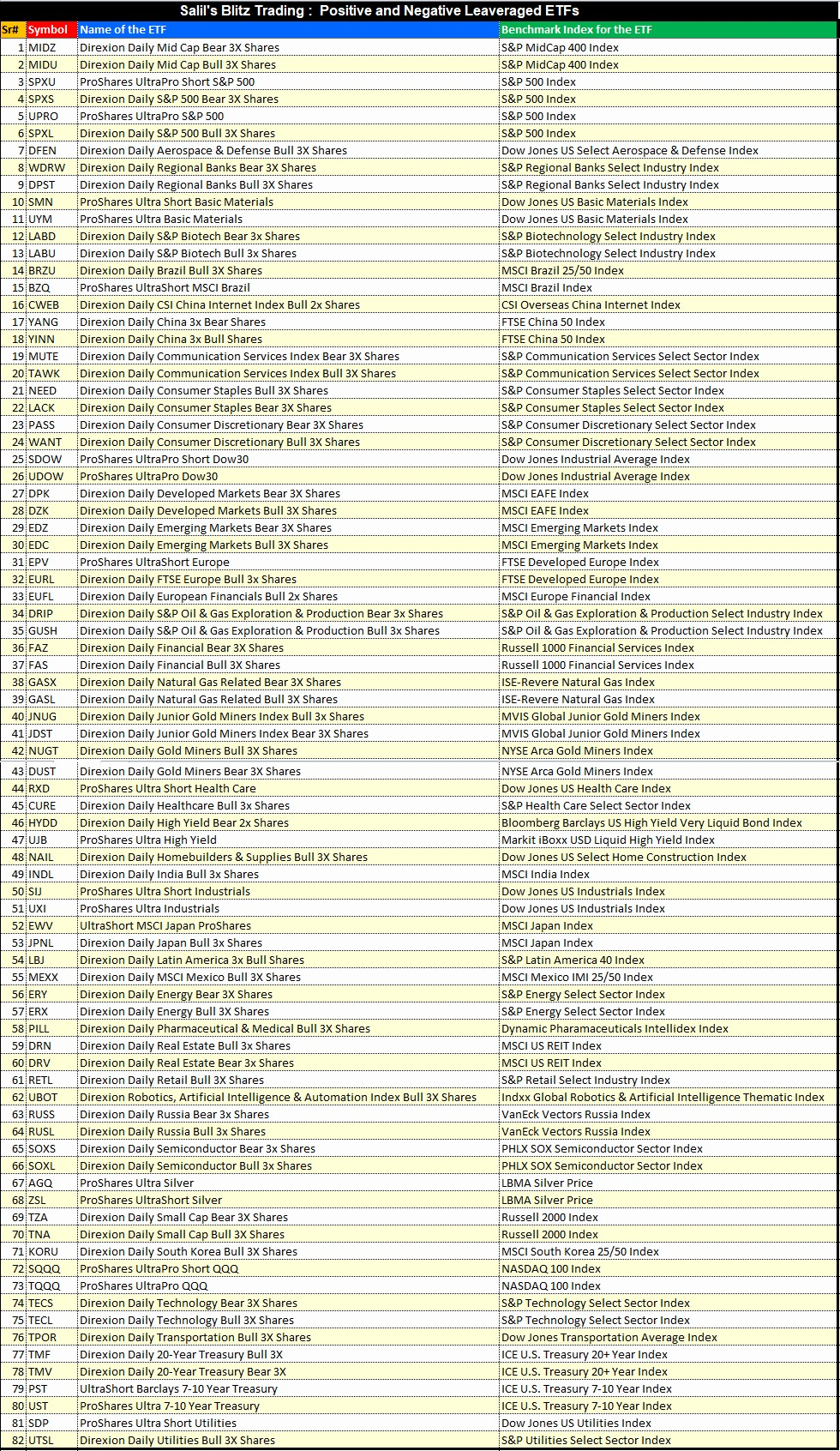

Blitz Trading: Positive and Negative Leveraged ETFs:

|