Profit making trading systems:

The most simplistic objective, for every trading system with the intent of profit making, is to buy low sell high. (There are some trading systems where the intent isn't profit making, instead it's 'tax-loss harvesting'. For such systems the simplistic objective does not apply.) Tactics to achieve 'buy-low-sell-high' in a cosistent manner involves using sophisticated algorithms, and implementing these in automated / semi-automated ways.

The algorithms that give consistent overall profits in all market conditions - during recession and expansion - in bull market and in bear market - during periods of inflation/deflation/stagflation are esential for a successful trader. To achieve this, I've designed sophisticated trading systems. (a) Fluctuation Trading (b) Wave Trading (c) Blitz Trading (d) Fibonacci ATR Trading.

All of these systems are my 'original' work. I retain the copyright of this intellectual property, however, I am permitting others to make use of the algorithms. For my original work, I've coined terms for each of these trading systems.

History: Fibonacci Series

Indian Mathematican/Poet Acharya Pingala (3rd/2nd century BCE) originally formulated the number series 0,1,2,3,5,8,13,21,34,55,..., which was restated by another Indian Mathematician Acharya Hemachandra (1150 AD), and again by an Italian Mathematician Leonardo Bonacci of Pisa (1240 AD).

<< BTW, Acharya Pingala is also credited with formation of Zero (Shoonya in Sanskrit), and binary system using Laghu/Guru (Both Sanskrit words meaning short/long). >>

Presently the number series 0,1,2,3,5,8,13,21,34,55,... is known as the Fibonacci Series. (After the first 3 numbers, subsequent number is the sum of the earlier two numbers.)

This series occurs in the nature, and quite often this series occurs in the price charts of various securities including ETFs/Stocks/ADRs/Bonds etc.

History: Average True Range (ATR)

A trader, in theory, can trade any security that has some amount of Volatility. Any security that stays constant is typically not used to trade at all, instead it's use is to settle the trades. (Some of the examples of the securities that do not change in value are Fiat Currencies, Money Market Mutual Funds, Stable Coins. All of these are used to settle the trades.)

The volatility can be measured by various technical measures. E.g. Alpha, Beta, Bollinger Bands, Keltner Channels, Average True Range, Ulcer Index to name a few. I prefer the measure 'Average True Range' that was developed by J. Wells Wilder in 1978. At the simplest it indicates in the past how much the security has moved up/down. This forms the 'profit range', and the 'next buy' level, and 'stop loss' level for me.

Since the ATR is dynamic - which changes every day, any algorithm that uses ATR by definition becomes an 'adaptive' algorithm, which adapts every day to the price of security.

For trading securities like ETFs, Mutual Funds, Cryptos I prefer higher volatility. However for trading the securities like individual ADRs/stocks, I have no preferance at all. Whatever be the volatility of the ADR/stock, the 'algo' I've designed adapts, with a lag of 1 day. The Algo design makes it automatically target the ADRs/stocks that are more volatile, instead of targetting the ADRs/stocks that are less volatile. (This is a distinction between 'machine-learning-algo' and 'adaptive-algo'. I've designed this algo to learn nothing, instead it constantly adapts to the price of individual ADR/stock.).

Past/Present/Future: Personal ADR/Stock Trading

Sporadically, I had used individual ADRs/Stocks for trading from year 2000 thru 2011. Since 2011 thru 2021 I did not use individual ADRs/stocks at all.

However, I have decided to use the individual ADRs/stocks starting year 2022, after studying/formulating/back-testing the tactic/algorithm for more than two years.

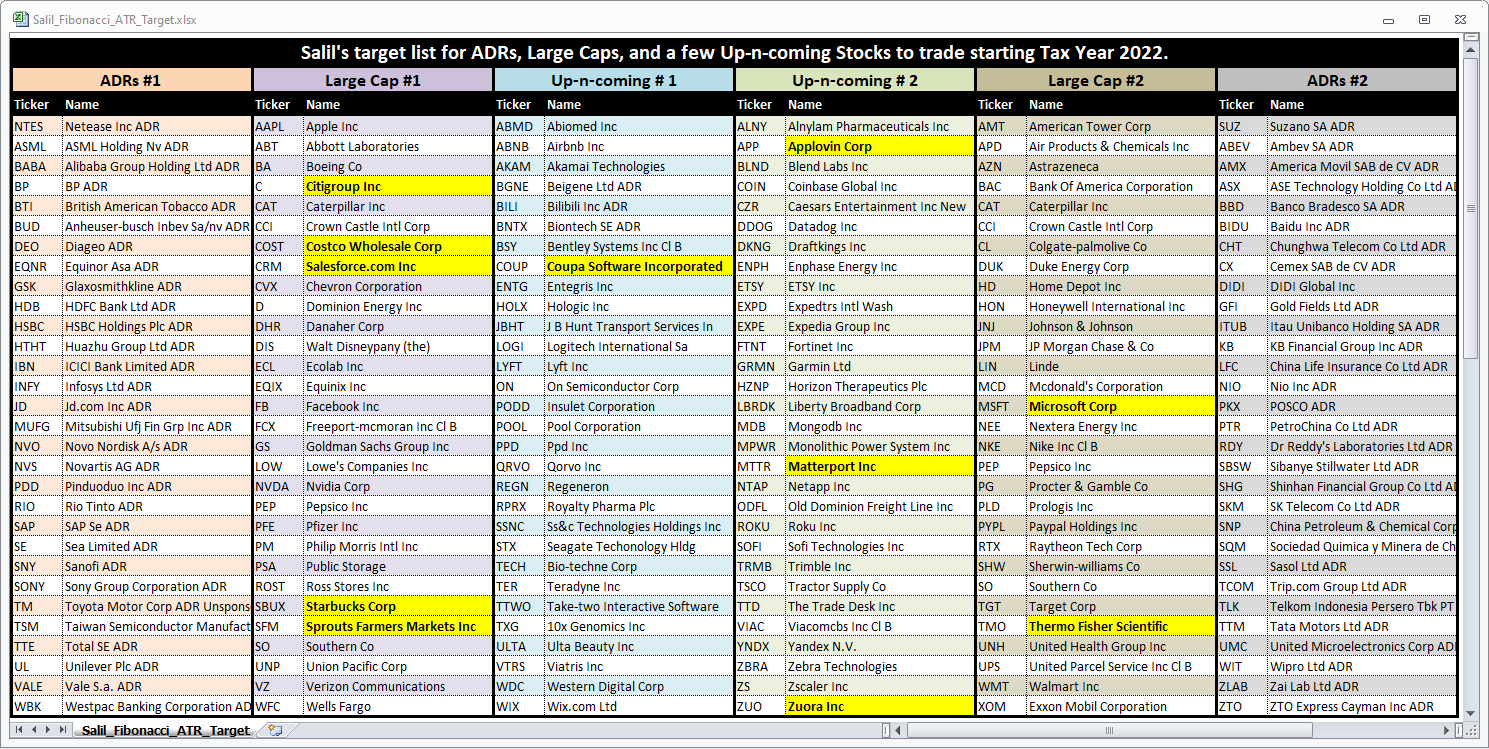

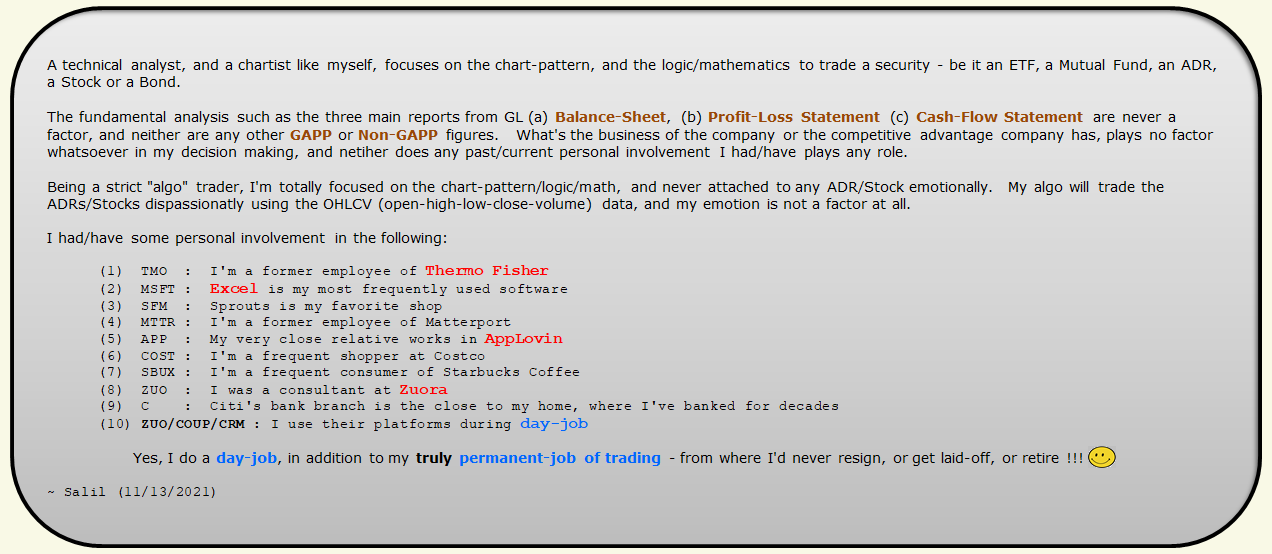

First task was to select target list of individual ADRs/stocks which will be traded by my algo. There are thousands of ADRs/stocks. As a starting I made a list of 180 individual ADRs/stocks, that I will target for trading, which I will adjust on an on-going basis. There's a possibility of merger/aquisition, delisting for ADRs/stocks. This makes it necessary to make adjustment to the target list on an on-going basis.

On a personal note, different employers have different restrictions about which ADRs/stocks must not be traded, therefore an on-going adjustment will be necessary for me, depending upon where's my current gig, and what restrictions my current employer/end-client has put in place about not trading specific ADRs/stocks !!

I've selected some of the well known ADRs (like BABA, SONY, BUD, SAP, ASML, INFY), a few of the well known large cap US Stocks (like CAT, MSFT, BA, COST, GS) and some of the up-n-coming US Stocks (like APP, COIN, SOFI, BLND, ZUO, COUP), and a few that are well etablished, and could make it into NASDAQ-100 someday (Like LYFT, REGN, NTAP, MDB, EXPD).

Lots of the ADRs I've selected are Level II. All the Level II ADRs, evenif they are not American Companies, must meet the SEC standards for financial report submission using the GAAP, and these must comply with SOX Act. (In my professionable life, I'm a SOX Analyst, so I know intimately the gruelling process that goes about to make sure that the company is doing great house-keeping !!)

The full list of ADRs/stocks, I will trade starting 2022, using Fibonacci ATR algorithm is as follows:

J. Wells Wilder Jr.

J. Wells Wilder Jr. was a pioneer in the field of Technical Analysis. Besides ATR (Average True Range), he developed indicators such as RSI (Relative Strength Index), ADI (Average Diirectional Index).

<< Earlier, I indicated that my emotions play no role in my trading decisions, instead my decisions are strictly based on the logic/math. Actually, J. Wells Wilder Jr. has some famous quotes about this. >>

Letting your emotions override your plan or system is the biggest cause of failure.

Some traders are born with an innate discipline. Most have to learn it the hard way.

If you can't deal with emotion, get out of trading.

Wikipedia of J. Wells Wilder Jr. has these quoes, and other information.

Fibonacci ATR Trading: Notes

I've designed this system for trading ADRs and Stocks.

This system is ideally suited where the broker has completely commission-free trading. (Since the year 2019, Charles Schwab, Vanguard, Fidelity, Alpaca followed the lead of Robinhood, and started offering commission-free trading, so in the US the comissions are a thing of the past. *smile*)

This system causes multiple/frequent trades therefore using this in a tax-deferred/tax-free account is preferable than using in a taxable account, in order to avoid the massive tax-reporting.

The price change of individual ADR/stock has two implications. The first is the change in price potentially changes the retracement level. The second is the change in prrice potentially changes the volatility. The Fibonacci number adapts to the retracement level, and the ATR adapts to the volatility.

Lastly this system needs daily trade entry, trade adjustment, as this is an 'adaptive' system that adapts every business day. Therefore, using this system in a brokerage that has APIs is preferable. (Doing manual trade adjustments each day of course is possible, however I am targeting 180 ADRs/stocks, therefore for me manual operation is out-of-the-question !)

Fibonacci ATR Trading depends upon the fact that in nature, and in price-charts the Fibonacci numbers are found all the time, and also the that each ADR/stock has it's own unique volatility.

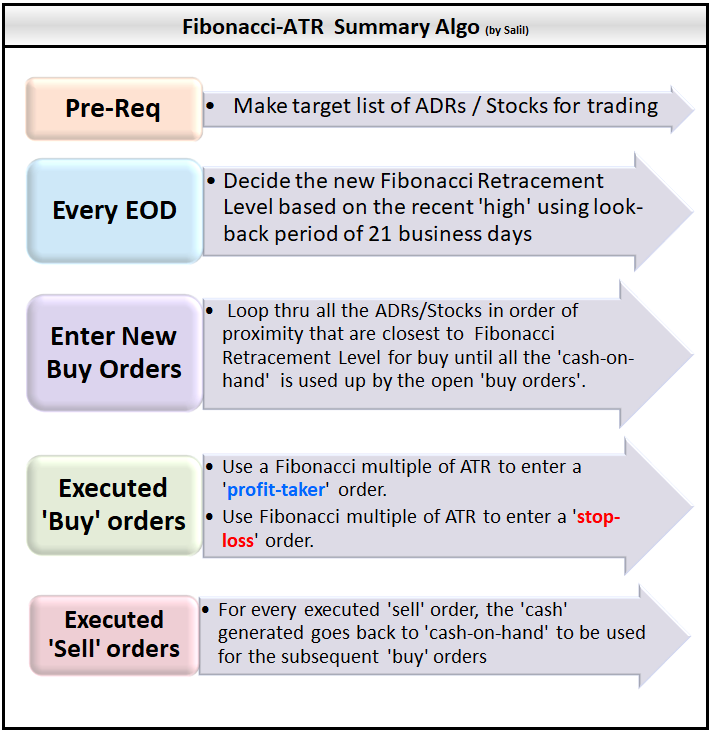

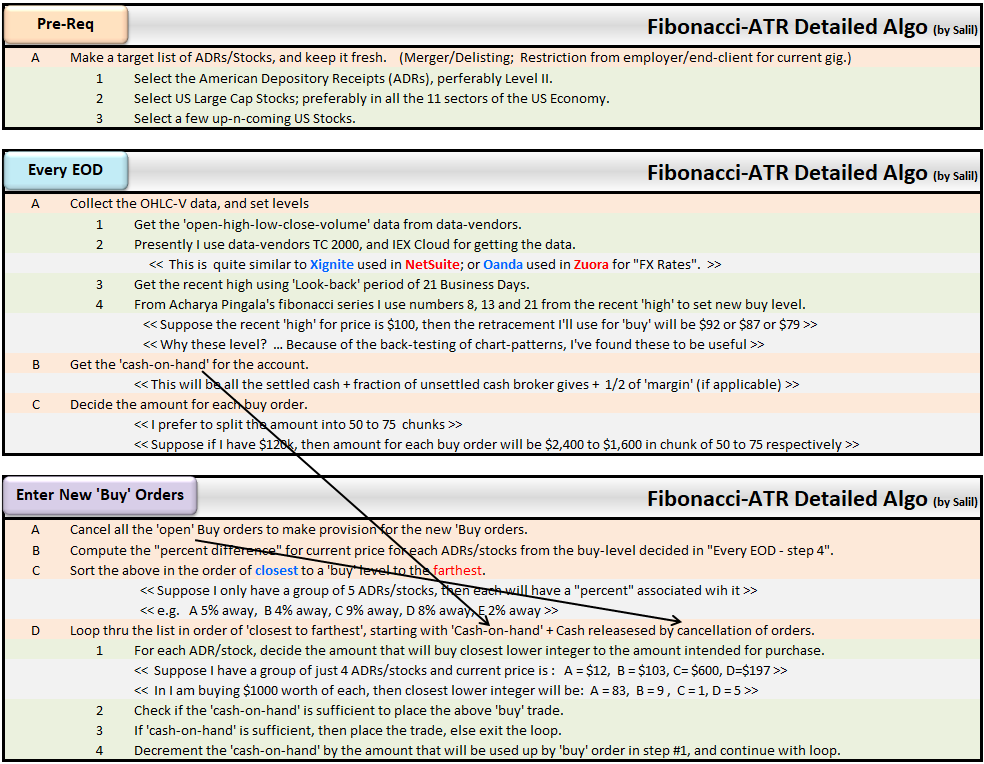

Fibonacci ATR Trading Algo:

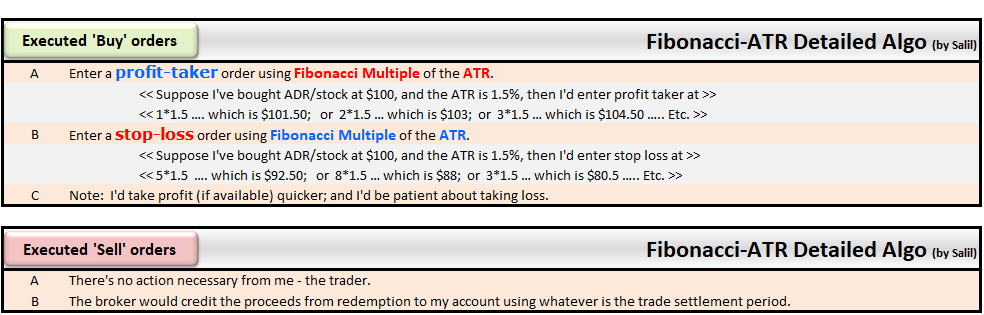

Summary

Details

Python:

In addition to being a trader, I am a coder as well, therefore, I've implemented the Fibonacci ATR algorithm using Python.

ATR is a built-in indicator in Python module TA-Lib. Several brokers offer order-entry using REST APIs.

I use broker TD Ameritrade for Rapid Order Entry using APIs.

I've given Python snippet of how to fetch the balance in TD Ameritrade brokerage in another article. (click here)

Live Test in PROD:

PROD in the context of trading algorithm is of course the US Financial Markets. I performed a limited deployment of Algo at my broker - TD Ameritrade, and used a few of the ADRs/Stocks in Novmber 2021, before doing a full deploy starting 2022.

11/13/2021: Starting post on Linked-in Click here

11/25/2021: The live test using Coupa's Stock Click here

Personal experience with other Alogs I've developed:

I've designed different algoritms for trading different securities. Here are the details for the various Algos, and actual results in PROD.

In the context of trading, the PROD is always a brokerage platform !!

Fluctuation Trading

8/7/2021 : BTCFX: I've given screen-grabs of my Trades at ProFunds giving 15% profit in 10 days. Click here

Blitz Trading

5/11/2021 : 177 Blitz trades at TD Ameritrade: Click here

7/9/2021 : 144 Blitz trades at TD Ameritrade: Click here

7/20/2021: 278 Blitz trades at TD Ameritrade: Click here

Crypto Trading

9/7/2021 : Large number of Crypto trades (168) in few hours at Binance: Click here

3/23/2021 : Crypto Trades for BITW at Fidelity: Click here

3/8/2021 : Crypto Trades for GBTC at Fidelity:Click here

March 2021 : Crypto Trades for BITW at Fidelity: Click here

1/25/2021 : Crypto Trades for BITW at Fidelity: Click here

|