|

Structured Notes

(recent development of ETFs that exibit Structured Notes like characteristics)

|

|

|

My experience:

I've traded Structured Notes for decades. Over this time-span I've traded 100+ Notes, and I've lost small sums of money only in 3 notes and for all others I've gained good profits. Therefore, my experience with the structured notes is extremely positive, and of course profitable.

In spite of my positive experience, it's worth noting that the Structured Notes are not insured by the FDIC. The Structured Notes do have the risk of losing complete principal.

The Structured Notes are illiquid - the market for these is almost non-existent after the inital valuation and earlier than the final valuation. I always purchase these on the first day at the initial valuation, and after that I let them go to maturity or get called, whichever occurs earlier. I have never purchased any structured note in between the term, and never redeemed any structured note before the maturity, or before the call.

I use brokers TD Ameritrade, LPL Financial, and Vanguard to purchase the Structured Notes. (Actually, I've developed a great working relatiohsip with the brokers from the Bond Desk at TD Ameritrade!)

I've used UBS Wealth Management Service for Structured Notes, however I do not have postitive experience with UBS.

I've explored HSBC Welath Management, amd Morgan Stanley Wealth Management as well, however the policies were not favorable, and both were non-starter for me.

|

Facts / Characteristics / Personal preferences:

- A Structured Note is a Debt Obligation of the issuing institute.

The Structured Notes are backed by the faith and credit of the issuer. (This indicates that if the issuer is no longer credit-worthy during the term of the Structured Note, then any accured coupon-payment/gain and even the principal may not be paid by the issuer, and the owner of the Structured Note may lose it all.)

- There are various kinds of Structured Notes:

- Principal Protected Structured Note:

Here the entire principal is protected from loss.

- Partially Principal Protected Structured Note:

Here some portion of the principal is protected from the potential loss. These often time offer a small buffer to avoid downside, and place a cap on the potential gain.

- Non Principal Protected Structured Note:

Here there is no protection offered to the principal, and there is a larger amount of buffer offered to avoid downside, and often times there is no cap on the gain, and/or there's a contingent periodic interest. (I almost always use these types of Structured Notes.)

- Non-Callable Structured Note:

Here the issuer cannot call-back the structured note ahead of the maturity.

- Callable Structured Note:

Here the issuer may call the notes ahead of the maturity.

- Phoenix Autocall Structured Note:

Here the issuer sets a condition for the call, and upon meeting the condition the Structured Note gets automatically called ahead of the maturity. If during the term the call condition is not met, then the structured note stays effective till maturity.

- Reverse Convertible Structured Note:

Here the structured note is tied to performance of a few stocks. The purchaser might get back the underlying stocks if the issuer issues the stocks rather than redeeming and giving back the monetary proceeds.

- The gains/losses resulting from purchase/redemption of structured notes are reported on 1099-B (Broker and Barter Exchange Transactions).

- When applicable, the coupon payments made for the structured notes are reported using 1099-OID (Original Issue Discount).

- I never purchase Reverse Convertible Structured Notes, Partial Protected Structured Notes with "Cap", and Non Principal Protected Structured Notes that are tied to performance of Currencies or Commodities.

I tend to purchase Non Principal Protected Structured Notes that offer some buffer against the downside, with some contingent coupon, that are tied to performance of - DOW Jones Industrial Average

- S&P 500

- Russell 2000

- Nasdaq 100

- Euro STOXX 50

- Various ETFs

- Constant Maturity Swap Rates for 10 year T-Bond, minus 2 year T-Notes (which is the Yield Curve)

- Stocks: AAPL, GOOG, NFLX, AMZN, C, BAC, WFC, UPS, FDX, TSLA ...

- ETFs: XLF, XLE, XLK, XLY, JETS, ICLN, TAN, ARKK ...

I publish Python/MatPlotLib generated Yield Curve values on this web-page with about 2 days lag.)

|

Issuers:

Following are some of issuers of Structured Notes. (I've used Structured Notes from each of them):

- JPMorgan Chase Financial Company LLC

- Barclays Bank PLC

- HSBC USA Inc.

- Credit Suisse AG

- GS Finance Corp.

- Toronto-Dominion Bank

- Citigroup Global Markets Holdings Inc.

- BMO Capital Markets Corp.

- BNP Paribas Group

- Lloyds Bank Corporate Markets plc

|

ETFs with some characteristics of Structured Notes:

From July 2018 for the first time an ETF issuer started offering ETFs that have a few characteristics of structured notes. The issue is Innovator ETFs. As of this writing, there are 6 ETFs offered. (Refer to their web-site for the up-to-date details.) Innovator ETF calls these types of ETFs as "Defined Outcome ETFs".

Following ETFs are available:

- Innovator S&P 500 Buffer ETF (July Series) ... Ticker: BJUL

- Innovator S&P 500 Buffer ETF (October Series) ... Ticker: BOCT

- Innovator S&P 500 Power Buffer ETF (July Series) ... Ticker: PJUL

- Innovator S&P 500 Power Buffer ETF (October Series) ... Ticker: POCT

- Innovator S&P 500 Ultra Buffer buffer ETF (July Series) ... Ticker: UJUL

- Innovator S&P 500 Ultra Buffer buffer ETF (October Series) ... Ticker: UOCT

As the names of each ETFs suggests, the performance of these ETFs is tied to the performance of S&P 500 Index, however the performance does not try to match the performance of S&P Index. (These ETFs are not expected to track the performance S&P 5000 Index. They are different in that aspect from the ETFs like SPY, IVV, VOO which are designed to track the performance of S&P 500 Index very closely.)

Also as the names of each of these ETFs suggests, there is some amount of protection against loss offered when S&P 500 Index loses value. This is quite similar the buffer offered by some of the Structured Notes.

The gain in each of these ETF relative to S&P 500 Index is 'capped' at some levels. (In theory, the gain in S&P 500 is limitless, however the gain in each of these ETFs is always capped, therefore even in theory the gain is not limitless.) Again this is similar to the 'cap' present in some of the Structured Notes.

The underlying securities used to make the Structured Notes are same/similar to those that are used to make these ETFs, therefore some of the charactristics are shared between these ETFs and the Structured Notes.

These ETFs are my on watch-list, and I plan to trade these over the years to come.

|

SEC - EDGAR:

Securities and Exchange Commission is one of the regulators that regulates the Structured Notes.

The issuers are required to file the preliminary prospectus (Forms : FWP, 424B2) with the SEC.

All of these forms from different issuers are available for free at the 'Electronic Data Gathering And Retrival' system. Here are links to DOCs from some of the issuers. These links are working at the time of writing. These of course may stop working in the future.)

- Morgan Stanley

- GS Finance

- Toronto Dominion Bank

- Barclays Bank PLC

Generally the Structured Notes are considered as special products. Lots of brokers simply do not offer these at all .. or .. do not offer these to retail traders at all. As of March 2019 brokers like Charles Schwab, Fidelity, Interactive Brokers, E*Trade, Robinhood, and Alpaca do not offer these to retail traders at all. (From time-to-time Fidelity offers Structured CDs - however there's big difference between Structured CD and Structured Note.)

Getting details for Structured Notes is not a easy task. Institutional Trading Firms have "Bloomberg Terminals" where the details for Structured Notes are readily available. It is said that a single user license for a Bloomberg Terminal is more than 20k per year. (That's much more than what a single user SFDC license or NetSuite License costs !)

So ... I download the details from SEC's EDGAR. I've given details of the Regulation, and Jupyter Notebook using which I download the details, and then scan thru them using grep at this link.

That's my "retail" trader/coder method of doing for free, what "institutional" investors would do using 20k single-user license of "Bloomberg Terminal". *smile*

|

Useful details fom SEC:

- Securities and Exchange Commission (SEC.gov): Investor Bulletin: Structured Notes

- Securities and Exchange Commission (SEC.gov): Investor Bulletin: Structured Notes with Principal Protection

- Securities and Exchange Commission (SEC.gov): Guide to Investing in Structured Products

- Preliminary Prospectus for CUSIP# 40056EWF1

- Preliminary Prospectus for CUSIP# 09709TNZ0

- Preliminary Prospectus for CUSIP# 48130UPF6

- Preliminary Prospectus for CUSIP# 06746XL92

- Comments by SEC Commissioner: Kara M. Stein

Cautionary comments (mostly negative), to discourage retail customers from using Structured Notes.

Excerpts:

Take, for instance, over-the-counter structured notes linked to bespoke indices. The index methodologies on which these products are based often involve some form of calculus or advanced math. The imbedded fees can be mind-numbingly complicated. Notably, the underlying investments can include instruments that would not be available to a retail investor directly. Despite this, these products are often sold to retail investors by financial professionals who make a lot of money by selling complex products. What's more, it's not even clear that all of these financial professionals fully understand the products they are selling.

Yes, I do believe that Ms Stein has a couple of points. One of them I believe is wrong, and the other I believe is right.

Wrong point:

I'm a retail customer. I'm an engineer, and used to work as a professor of Math, in an engineering college, and I fully follow the algos/math used for the structured products.

But the implied assumption, that a retail customer absolutely must understand these calculations, to be able to use these products, seems questionable. The implied assumption, that retail customers can only understand dumbbed-down/simple products, therefore ought to use only simple products is so very inaccurate.

How many of us understand the internal-combustion-engines, and the spark-plugs, and how many of us understand the MP4, and the FLV formats? ... Yet we drive the cars, and play the videos without thoroughly understanding these anyways - don't we? *smile* ... So the knowledge of the inner working/calculations of Structured Products may not be necessary for a retail customer, to profit from it.

Right point:

Yes, the (so called) financial professionals do make a lot of money, and yes, I have my doubts whether these people themselves understand the algorithms and calculations given in the Prospectuses (Forms 424B2, and FWP) that they are selling.

(When I order my brokers to purchase Structured Notes for me, then such orders are classified as 'unsolicited' orders, therefore my broker is not expected to understand these products at all, instead I take the full responsibility of understanding the products I'm purchasing.)

|

Real Life Example:

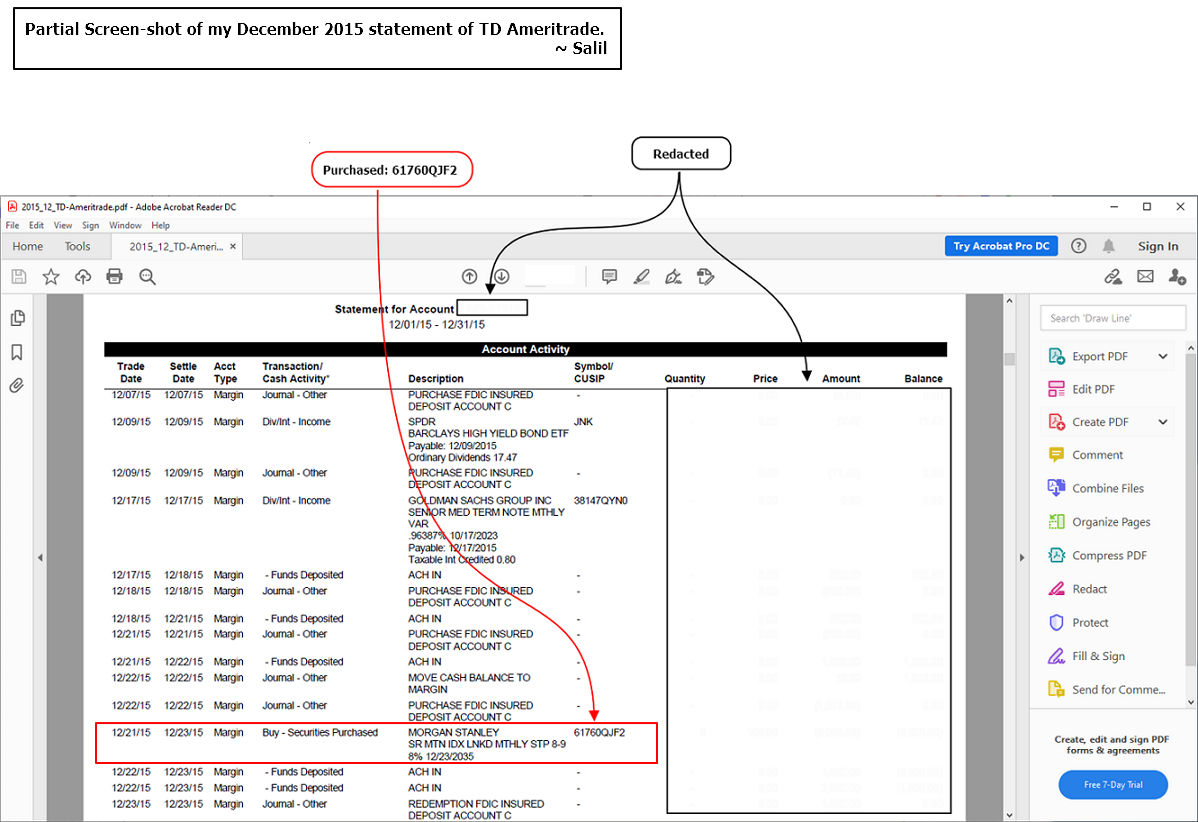

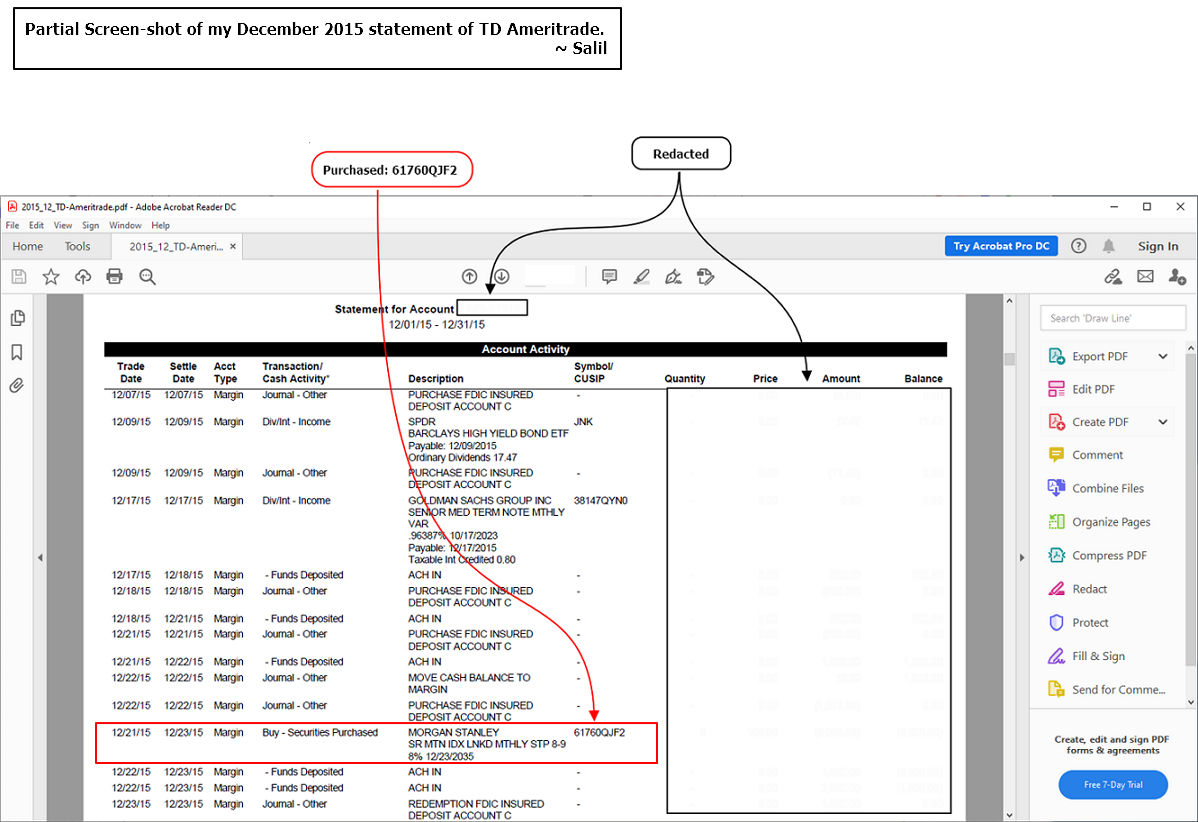

I purchased Structured Note CUSIP# 61760QJF2 in December 2015. Part of TD Ameritrade statement is given below. I've redacted some of the details.

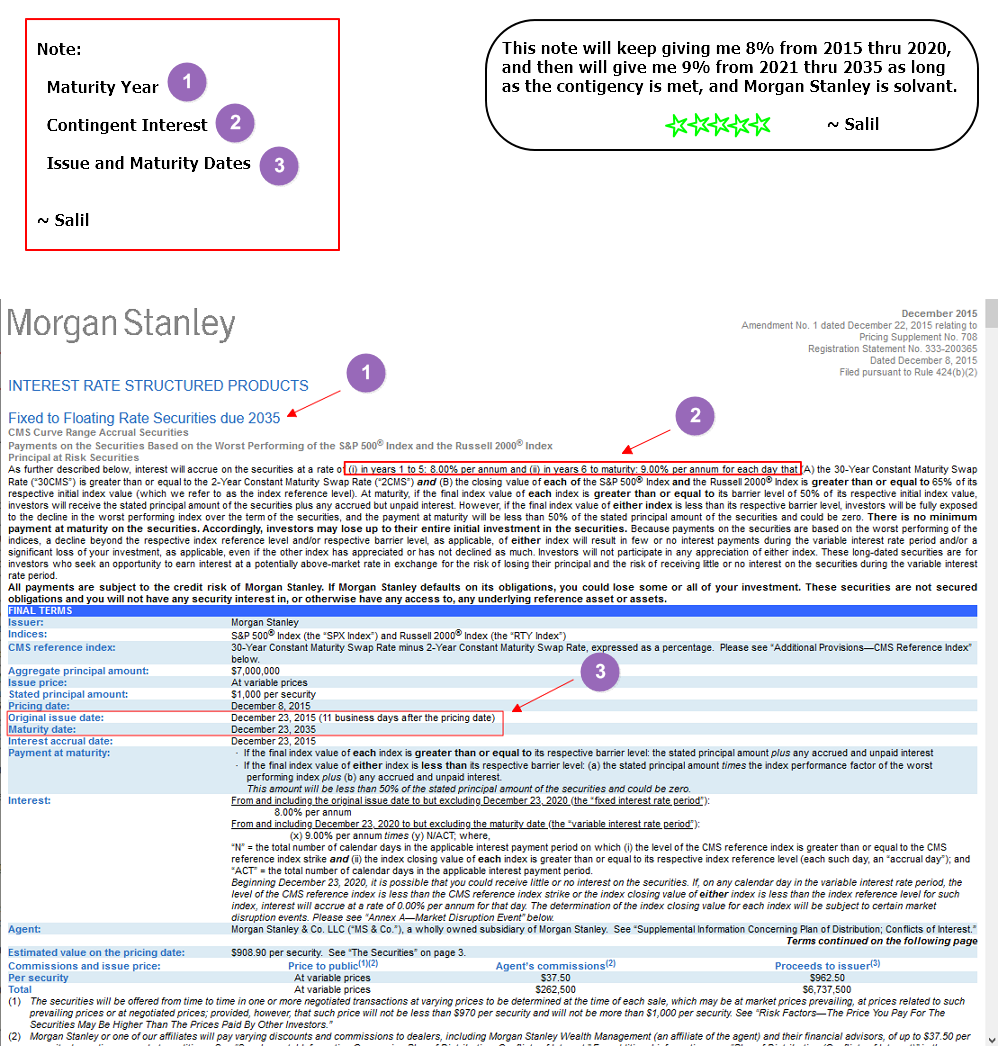

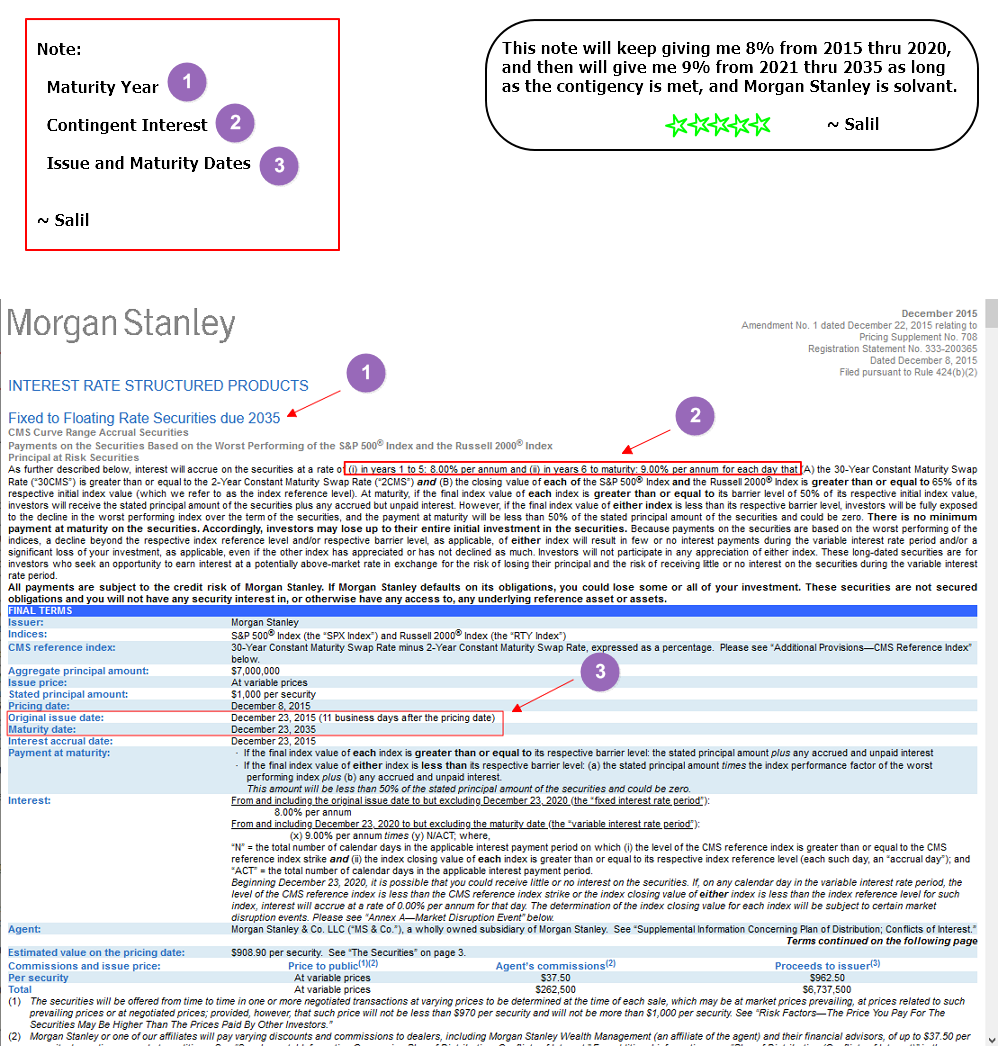

Click here to get the full Form 424B2 (Prospectus). The relevant details are given below.

| Detail | Value |

| Maturity Date | December 23, 2035 |

| Callable | No |

| Coupon | Fixed 8% for first 5 years

Contingent 9% for next 15 years |

| Contingency | On each day within the last 15 years

if 30 year Constant Maturity Swap Rate is lower than 2 year CMS Rate

or if S&P 500 is lower than 1,303.6075

or if Russell 2000 is lower than 728.663

then coupon is 0% for that day

else the coupon is 9% for that day |

| Contingent Principal Payment | At Maturity if

either S&P 500 is lower than 1,002.775

or Russell 2000 is lower than 560.51,

then 50% of Principal will not be paid.

Each Subsequent Drop in S&P 500 or Russell 2000 will result in each percent loss in Principal |

|