Accounting / General Ledger / Finacial Statements:

I'm a trader, and a coder. and I do full-time job as a trader/coder that I will continue till I die :-) (Click here to read about the retirement.)

However, for last 25+ years, I've been doing a day-job in IT Department, where I deal with financial transactions all the time.

(a) Accounts Receivable Transactions, (b) Payment Transactions, (c) Accounts Payable Transactions, (d) Refund/Credit Transactions, (e) Deferred Revenue Transactions ... the whole gamut.

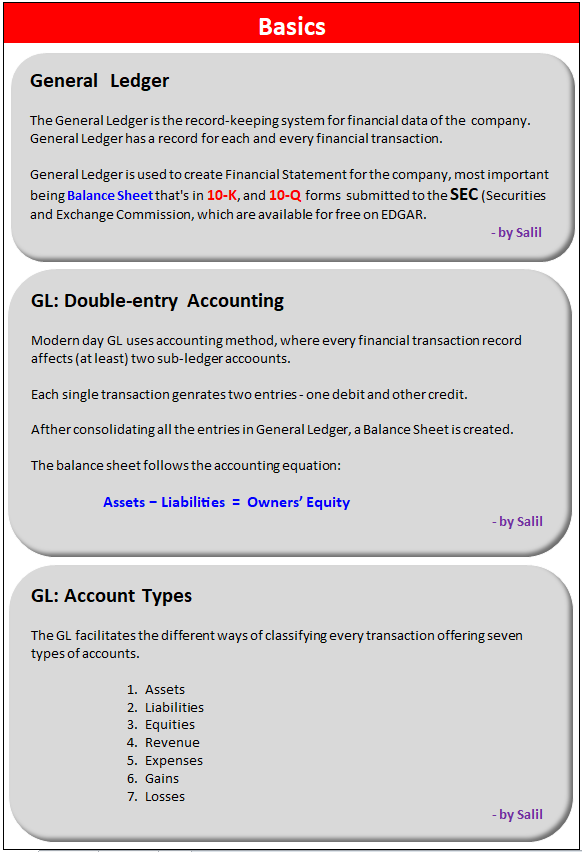

Here are the basics of the General Ledger and the Three Financial Statement where all of these financial transactions get (a) recorded (b) rolled-up (c) reported.

|

|

Slideshow (use dots/arrows at the bottom to scroll)

Click the above dots/arrows to move thru the slides.

|

ORACLE NetSuite: Journal Entry Slides:

Oracle NetSuite offers a clear/concise way of making a Journal Entry using CSV Import.

I'm giving below six slides of the steps needed to make a simple Journal Entry.

Slideshow (use dots/arrows at bottom to scroll)

Click the above dots/arrows to move thru the slides.

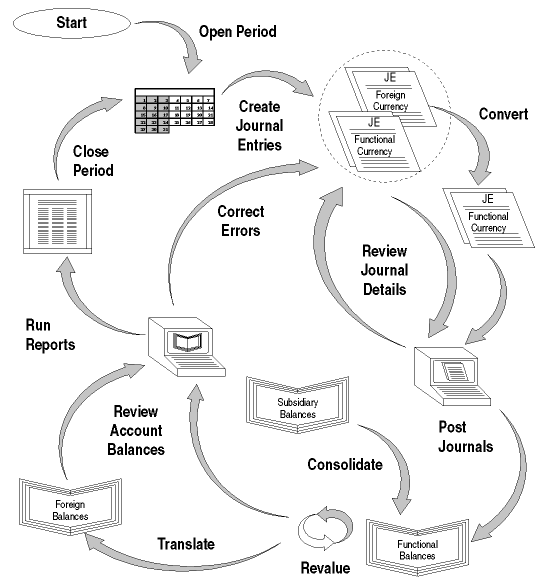

ORACLE R12 - GL Accounting Cycle:

For large corporations Oracle NetSuite is just not enough. These corporations often time opt for Oracle R12, Oracle Cloud Financial, JD Edwards,SAP etc.

Primary base tables for Oracle Cloud Financial GL are

(a) GL_LEDGERS,

(b) GL_JE_BATCHES,

(c) GL_JE_HEADERS,

(d) GL_JE_LINES, and (e) GL_CODE_COMBINATIONS.

Picture of the full GL Accounting cycle is given below.

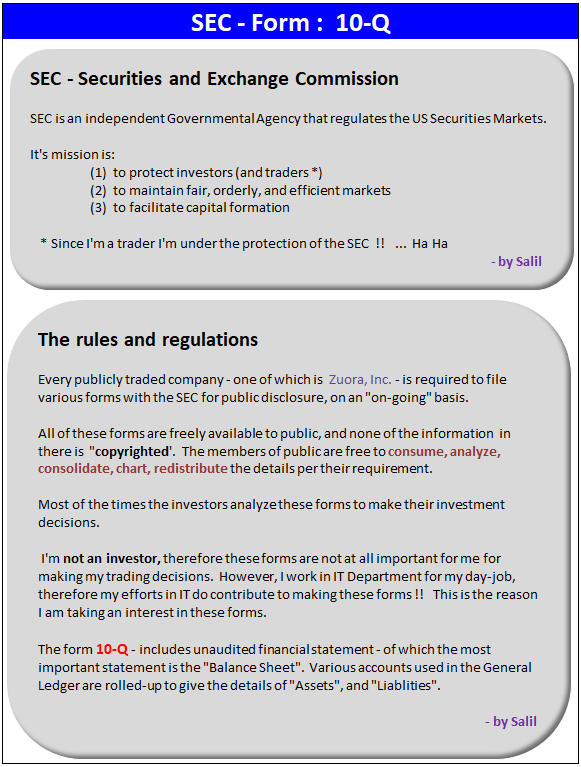

Securities & Exchange Commission (SEC):

After the stock market crash of 1929 at the height of the depression, congress passed Securities Act of 1933, and later Securities Exchange Act of 1934. These two laws created the SEC.

SEC is formed as a quasi-governmental organization. It is empowered to make regulations, as well as to enforce them. Before 2002 SEC was charged with enforcing just the Securities Acts of 1933, and 1934.

After the Enron and WorldCom accounting scandals, congress passed Sarbanes-Oxley Act of 2002. The Congress gave additional responsibilty to SEC, to enforce SOX law as well.

Yes, I do SOX work as part of my day-job !! Click here to read about SOX.

While analyzing various High-yield, Municipal, Emerging Markets Bonds, I use the measure created by SEC called '30-day SEC Yield'. Click here to see material related to it.

Protection offered by SEC:

It might appear that the 'protection' offered by SEC is just notional protection. However, such is not the case at all. This protection is real. I have personal experience of this protection!

I don't trade too often in 'taxable' accounts, but in years 2014 thru 2016 the situation required me to do trading in taxable accounts quite frequently. For this trading, I decided to use broker ProFunds, whose positive/negative leaveraged Mutual Funds are very suitable for my 'algorithmic trading'.

Originally, this broker refused to obey the IRS Publication 550; Page 46; Point #2. which is about the 'cost-basis' for the shares purchased, and redeemed at different times - which is known as the 'Specific-share-identification' method, and receiving the trade-confirmation with the specifications. (I had explored other methods viz. FIFO - first-in-first-out, Average-Cost, etc. but these were unsuitable.)

Click here to download Publication 550. Page 45, 46, 47 has detailed explanation, with examples, that ought to be easy for IT Professionals to follow along.

I had designed algorithm to use 'Specific-Lot-Indentification'. When I design an algo, I start with the chart-patterns, volatility, laws/regulations/statutes, the Trade-Date+Settlement-Date lag etc. as the basis. The only aspects that are variables in my algo design are the Open-High-Low-Close-Volume values for the for the ETFs that change every day. For Mutual Funds the variable is closing Price - Net-Asset-Value - that changes every day. I consider the other factors as constants. If there's non-compliance by the broker, then a constant would not remain a constant at all, instead it will become an unknown-variable! (No traders/coders I know, have ever designed an algo that can accommodate an unknown-variable like violation of the law. *smile*) I don't consider non-compliance with the law as a valid test-condition, when I test the algo.

So, I engaged the broker. I made three successive complaint with the SEC about the broker, as I went along.

- Click here to download the first complaint I made with SEC.

- Click here to download the second complaint.

- Click here to download the third complaint letter, where I made a request to SEC for a 'cease-and-desist' order against the broker.

Finally, broker decided to do the right thing ... err ... after trying everything else !!! Click here to download the letter from broker that's written by the Head of compliance of the broker. Yes - the (1) un-redacted Account Number, and (2) PII information are both displayed in the correspondance - but that's just fine with me. *smile*

I, of course, won the case, because both the IRS and the SEC were with me !! I've given the whole lot of details at the URL: http://salilgangal/pro.

If a retail trader has an issue with a broker, then SEC offers protection. (Aha ... yes ... even FINRA and ERISA offer their assistance ... I have experience with both FINRA and ERISA as well ... maybe I will document those some other time. FINRA is Financial Industry Regulatory Authority. It's not a government agency. ERISA is a part of DOL - Department of Labor. It's a part of the government. It has power of enforcement for the matters related to Retirement Accounts.)

Circuit Breakers:

SEC is charged with maintaining 'orderly' markets. From time to time due to excessive volatility the 'order' is lost. SEC has impelemted a process of pausing all trading in the financial markets by a mechsnism of 'Circuit Breakers'.

All of the trading on all of the American exchanges is halted when the criteria established by SEC is met. This halt applies to NYSE, AMEX, NASDAQ and all of the ECNs (Electronic Communication NetWorks) Examples of ECNs: IEX, Arca Edge, CSX, Direct Edge, Lava, Bats etc.

IEX is founded by Brad Katsuyama who testified in front of 'Senate Permanent Subcommittee on Investigations'. The recoding of the testimony in front of the Chairman Sen. Mark Levin, and Ranking Sen. John McCain is available at C-SPAN.)

During the COVID-19 induced panic in March 2020, there were many days on which the Circuit Breakers were triggered. As a result, the trading was halted for the time specified.

Click here to download the 18 Page PDF of the SEC Order. Click here to see the Bulletin.

(In my algo for trading, I always make provisions for extreme volatility - maybe I will document this, when I will do a write-up for ATR - the Average True Range.)

Form 10-Q Details:

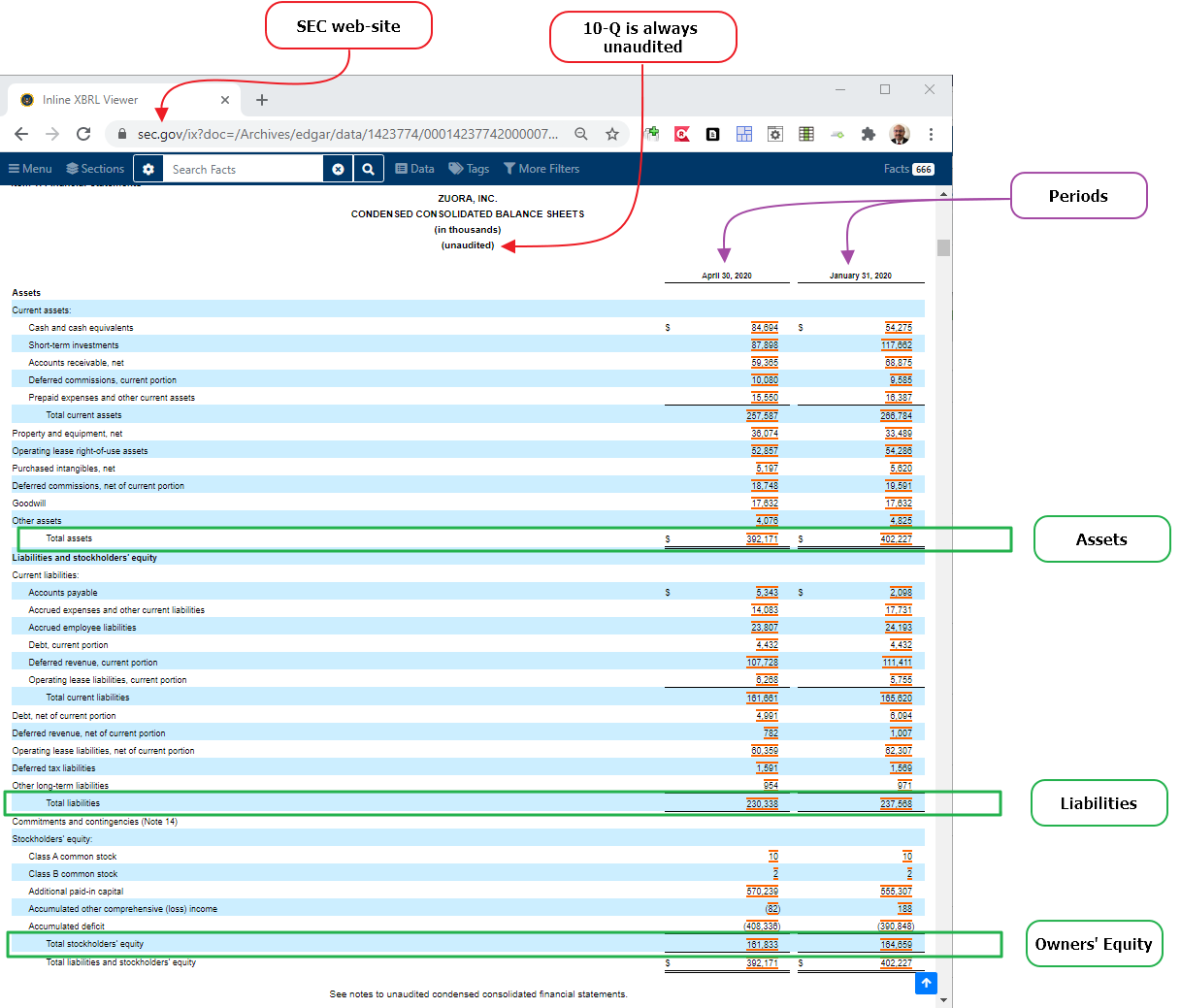

Following is the screen-grab of Form 10-Q for Zuora, Inc from the SEC's site.

The Form 10-Q details are always un-audited, as against that the Form 10-K - Anuual Report - is always audited.

I've marked the key details (a) Assets (b) Liabilities, and (c) Owners' Equity.

Click here to download the full 10-Q from SEC.

What else is there in 10-Q?

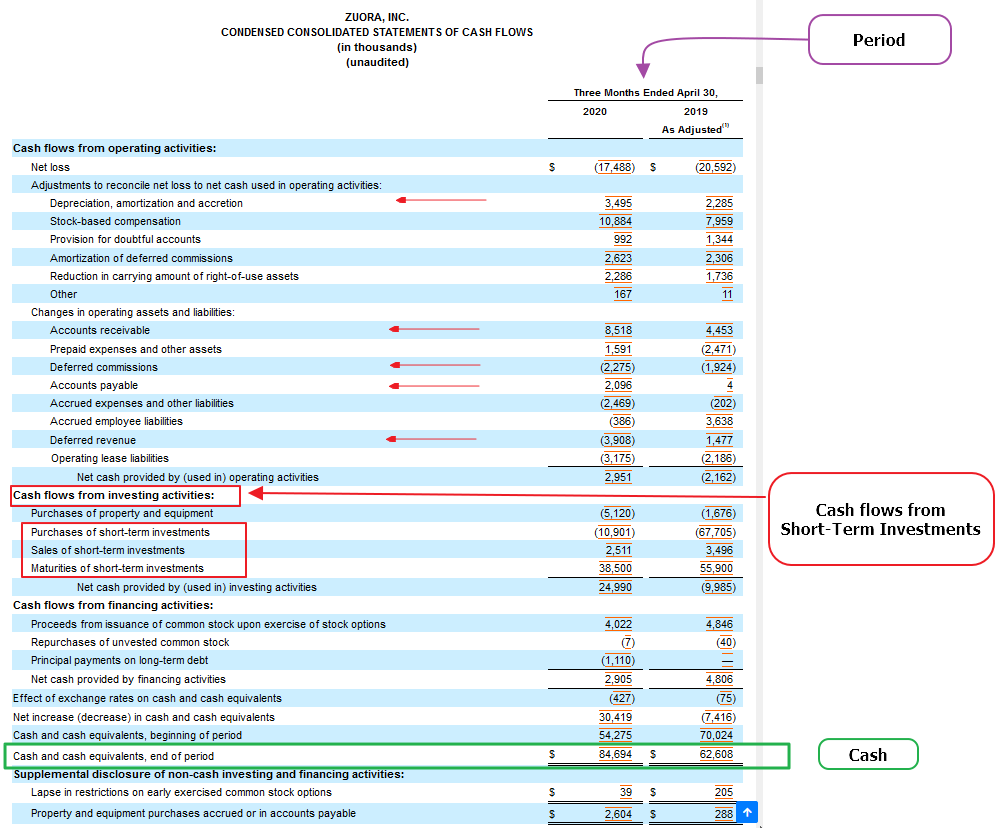

Another important statement included in 10-Q is the Cash Flow Statement. Many of the details in the Cash-flow originate from the General Ledger.

- Accounts Receivable

- Accounts Payable

- Deferred Revenue

- Deferred Commissions

- Depreciation

- Amortization

Cash Flows from Investing activities:

Regular companies are not experts at managing their cash. I don't even expect them to be experts. They ought to be experts at their core business. (e.g. I'd expect Nike to be expert at making/selling shoes, not necessarily at managing the Investing activities - especially the ones that involve actual Short-Term handling of the Cash.)

Often times this important aspect, especailly in the small/mid sized companies - much smaller than Nike - is ignored. The involvement/attention is quite superficial. Most of the time this responsibility is given to a management company that offers Corporate Banking / Corporate Financial Management services. The in-house staff is quite meager. All they are expected to do is to liaise with external service-provider, rather than making some smart decisions about the management of where/how/when does the cash gets allocated.

I strongly believe that this aspect deserves much more attention than is commonly given at small/mid sized companies.

I, of course, manage my cash as smartly as I possibly can. Since October 2019 - when most major brokerages made all the on-line trades commission free - Cash management has become an interesting and profitable topic for me. Click here to read material about this, where I've published code to automate some part of cash-management.

[This is an update as of 2/21/2021: In January 2021 Tesla made about $1.5 billion dollars "investment" into bitcoin. It is estimated that by now the that investment has grown to about 2.5 billion dollars. This is an extreme example where the compnay's management has obtained an outsized cash flow from 'short-term' invetments.]

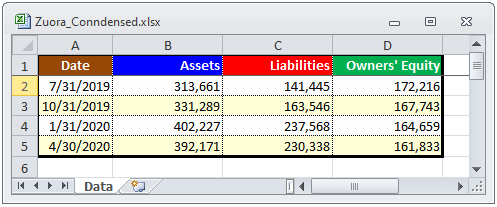

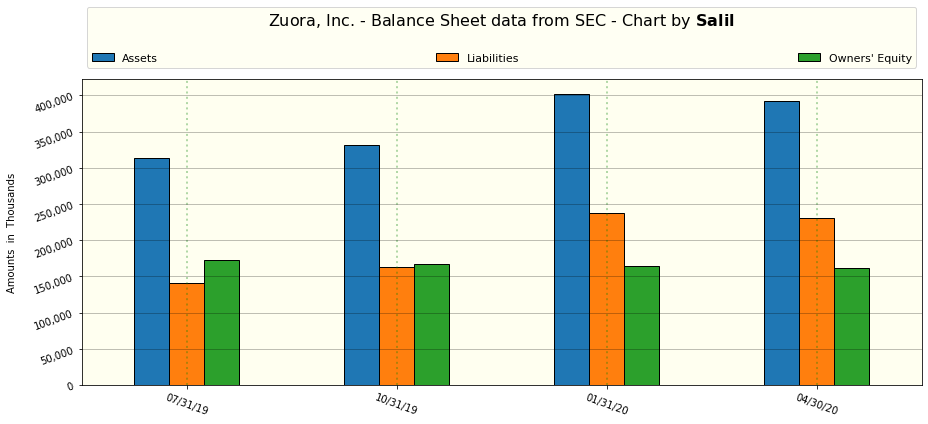

Past Data: Table and Chart:

I downloaded the past 10-Q's from SEC for Zuora, Inc. (Click here) Following values for Assets / Liabilities / Owners' Equity are reported for last few quarters.

I'm a technical analyst. My favorite magazine is Technical Analysis of Stocks & Commodities, so doing 'fundamental analysis' using 10-Q, then charting the balance sheet is of no use to me, for my trading at all.

Moreover, I don't trade 'individual' stocks. I have no interest in trading ZUO, instead I only trade ETFs, and Mutual Funds. (My last trade for an individual stock was in year 2011. Since then I've not traded any individual stocks.)

Neverthless, I coded a Python program to read the above workbook, and to plot the chart below, because it's fun to use Python/MatPlotLib.

My Frequent Use of SEC - Forms 424B2, and FWP:

I use Structured Notes very freuqently. Click here to read the material I've published about these securities.

The Structured Notes are vast. The number of Structured Notes are many many times more than there are total Stocks, ETFs, and Mutual Funds - combined. Getting the material about these on a regular basis is not a very easy task. At brokerage houses such as TD Ameritrade, Ameriprise, Bank of America there are teams that hunt for these on Bloomberg Terminal. I'm a retail trader, and I don't have Bloomberg Terminal. There also is system named as Simon Spectrum used by many of the brokerages that offer Structured Notes. (Simon Spectrum can be used to track how the note would have done had it been in existance in the past - in short back-testing.)

A signle user license for the Bloomberg Terminal is said to cost more than 20k per year, which is way more than what it costs for a company - say - to get a single user NetSuite, Coupa or SFDC license *smile* ... so I use SEC, and the automation I've developed using Python to hunt for these securities !!

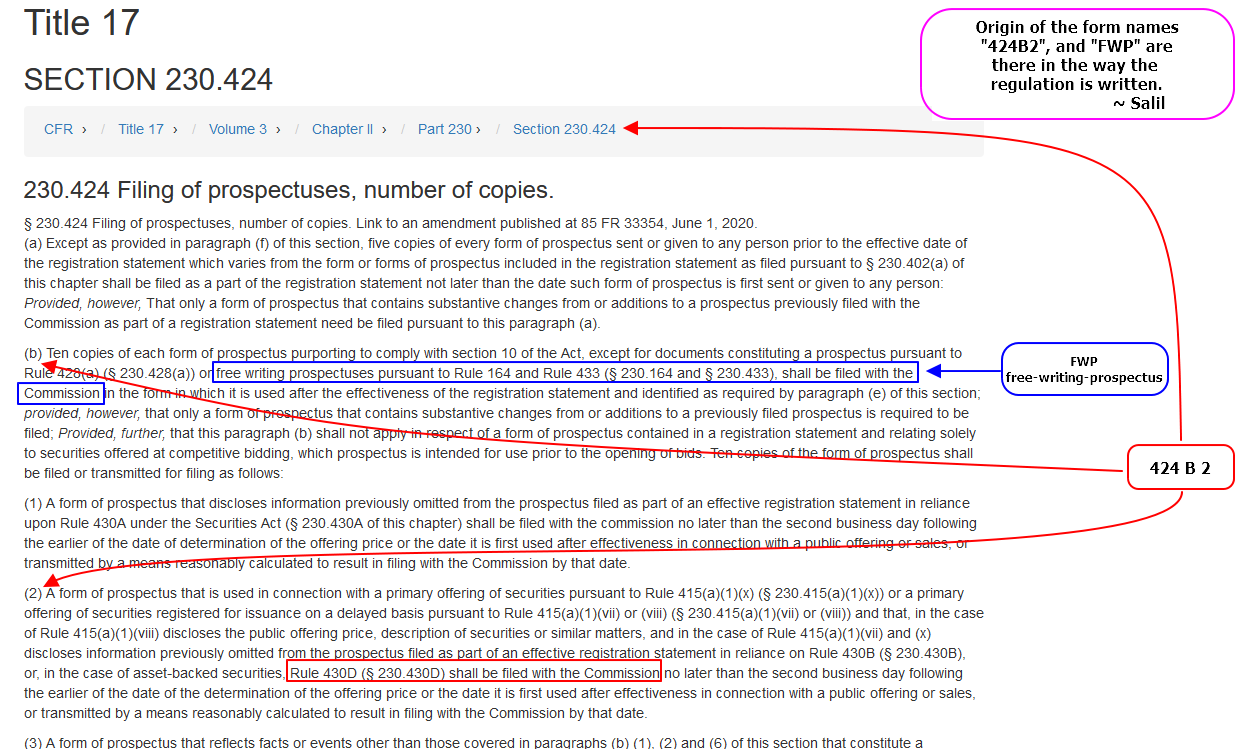

SEC regulates the Structured Notes issued by various issuers in the USA. A part of the regulation is that every issuer must file the Prospectus with SEC, for each and every Structured Note they want to issue. The corresponding forms that the issuers file are called as forms "424B2" and form "FWP". These Prospectuses are made available to public on EDGAR in the form of "htm" files. (All of these files have the verbiage "424B2" or "FWP" within the filename.)

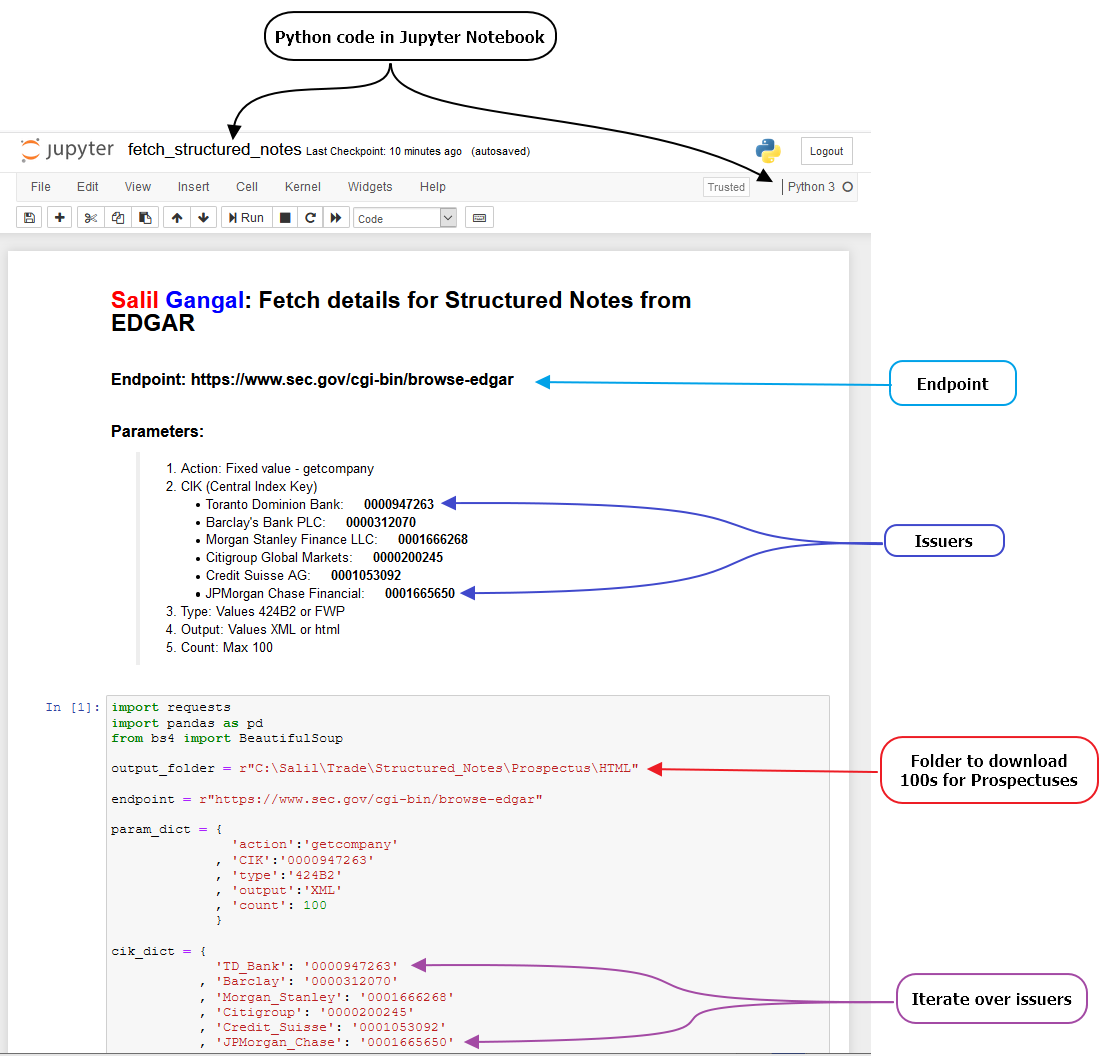

Further below I've given screen-grab of Jupyter where I've listed the Endpoint, and Type of the form as either '424B2' or 'FWP'. The screen-grab+annotations below elaborate the origins of the form names, hence the reason that the endpoint and type are with this specific verbiage.

Key - figuratively and literally - for fetching any data from SEC is the CIK, which stands for Central Index Key. Each company/entity registered with the SEC is issued a CIK, using which every file that exists at SEC for public consumption can be fetched. The prospectuses filed are of two types. The origins for both types are listed in the regulation above.

Click here to see details from SEC for latest 100 Structured Notes by the issuer Credit Suisse. Click here to read more about the Structured Notes I've written, including some of the negative points of Structured Notes.

I'm always looking for new Structured Notes, so I download the Prospectuses from SEC very frequently - at least twice each month. Typically there are 1000s of Structured Notes issued every month, so a manual operation of downloading, scanning, zeroing-in on the Note(s) I want to consider for purchase, would be a boring/tedious task which will become totally impractical if I were to do it month-after-month for years.

Naturally, I've automated most of download/scan/zero-in using Python/BeautifulSoup and grep/xargs of GnuWin32. Here's portion of the markdown/code in Jupyter Notebook.

Usually I download 1000s of Prospectuses. Just to demo the download process, I'm giving below a 'download run' where I've adjusted the 'Count' parameter to get just 5 of the Prospectuses for each of the issuers.

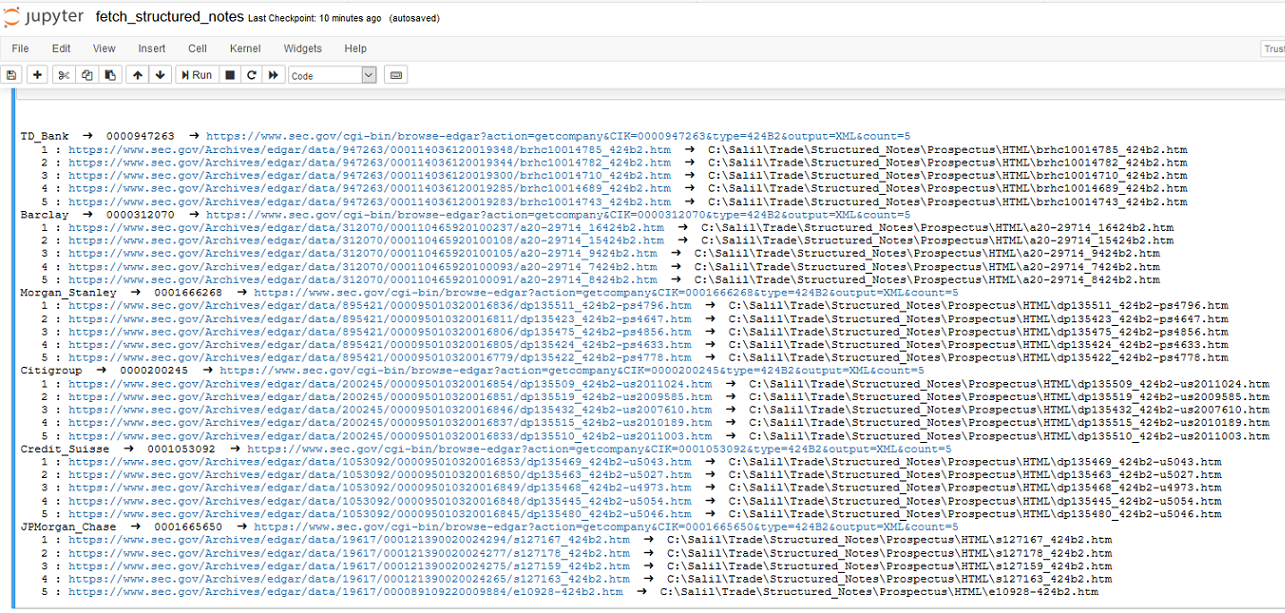

Following screen-grab shows output Jupyter Cell.

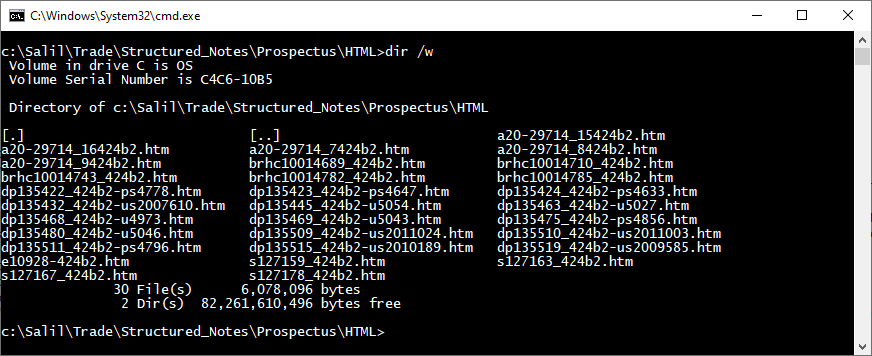

The following 'dir /w' commnd shows the 30 Prospectuses ( 6 issuers X 5 each ) I downloaded from SEC for this demo.

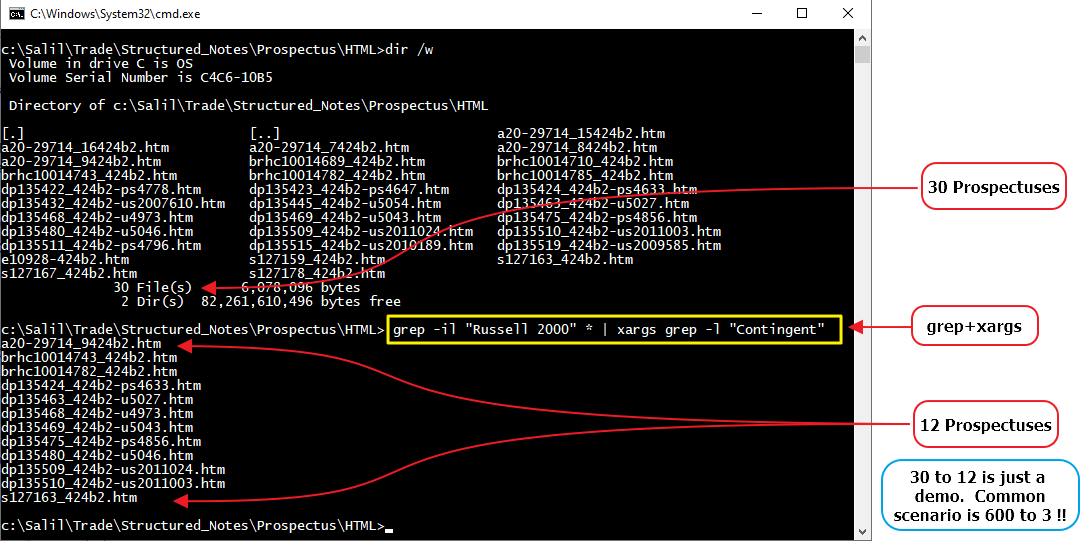

Now, to search for the Prospectuses I want, the step is to use grep/xargs to scan the Prospectuses that match my preferences given in second section.)

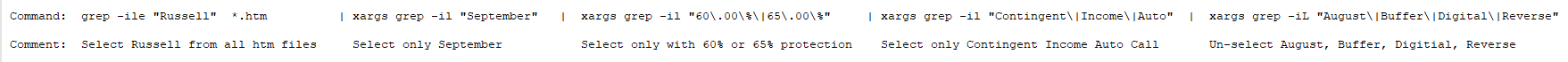

e.g. If I want to search for Structured Notes that are based on "Russell 2000" index which have "Contingent" income, then the following grep+xargs command narrows down the list of Prospectuses from 30 to 12. I can keep adding more conditions to make the selection narrower.

The demo below is 30 Prospectuses filtered into 12. It's quite common for me to automate this to filter 600 Prospectuses into 3 Prospectuses !!

Demo: grep -il "Russell 2000" * | xargs grep -l "Contingent"

In real life, I use more commands to narrow-down the selection to a few Notes. (Click on image below to expand)

In short, SEC is a great resource that offers lots of useful details for traders. I make generous use of SEC regularly. I consider SEC as my 'data-vendor' from where I can get regularly updated structured data for my consumption, pretty much like I use paid data-vendrors like 'Worden Brothers TC2000', and 'IEX Cloud' to get structured data.

( Among the government sites, I use US Federal Reserve, much more frequently than SEC, as my data-vendor !! )

All of these details from SEC are free ...

.... err ... maybe not ... I pay for 'sec.gov' when I pay my Federal Taxes ... *smile*

|