Retirement:

For most of the countries in the western civilization, the working age is generally between 20/25 years thru 65/68 years. After 65/68 years oftentimes the workers retire, and these days with ever incresing life-spans the retirement is from years 65/68 thru 95/98. That's about 30 years.

These 30 years often are glorified as 'golden' years. Years when the retired workers relax, travel to destinations they always wanted to, and check-off the items on the bucket list.

For those workers who have saved enough, and have good health, the above glorious things are doable. But for those who have not, this period of retirement is rather grim period, fraught with worry of how not to outlive one's savings. More often than not, for many retirees the travel destination is not some exotic tropical island, but rather it is the neighbourhood pharmacy, and the clinic of the primary-care, and special-care physician. In any case, it's important for one to have enough money for about 30 years of life, when there's no pay-check/salary at all, and oftentimes when the health is failing.

... well folks ... that's my take on the retirement ... especially for the retired workers who won't be getting any salary for about 30 years ...

The question, one perhaps should ask oneself is: Will I have enough savings, that will sustain me for 30 years, during which I will get no salary?

Retirement Plans:

In US, the forced retirement age was abolished in 1986 by including 'Age Discrimination' within the Employment Act. (There are few exceptions viz combat military personnel, airline pilots etc. )

Next, to care for the elderly US Government created many programs. Programs such as (a) Social Security, (b) Medicare, (c) Retirement. Out of this the Social Security is projected to go bankrupt. The projections keep varying as the situation varies. So ultimately the responsibility of supporting one-self financially is placed (rightly so in a capitalistic country such as the USA) upon one-self. Retirement Saving plans were made to assist in this.

There are several plans that allow workers to provision for their retirement - (a) Pension Plans (b) Traditional IRAs (c) ROTH IRAs (d) 401(k) Plans ...

Retirement for me:

I do not foresee any retirement for me at all, because I do not equate the 'retirement' with the absence of 'employment'. I stopped my employment a while back, however my permanent 'job' as a Coder/Trader continues, which fetches me income higher than my employment salary. I hope that my job will continue, so long as I am able to code/trade, hence no retirement for me at all !!

Notable individuals, such as Warren Buffett, Carl Icahn, Clint Eastwood, Judi Dench, Ratan Tata, Amitabh Bachchan kept working well past the conventional 'retirement' age, and I have intention to keep on working as well. My passion for logic/algorithm/data-structure and it's practical application to the Financial Markets is what makes me keep working, without any need to seek 'retirement'.

The Law:

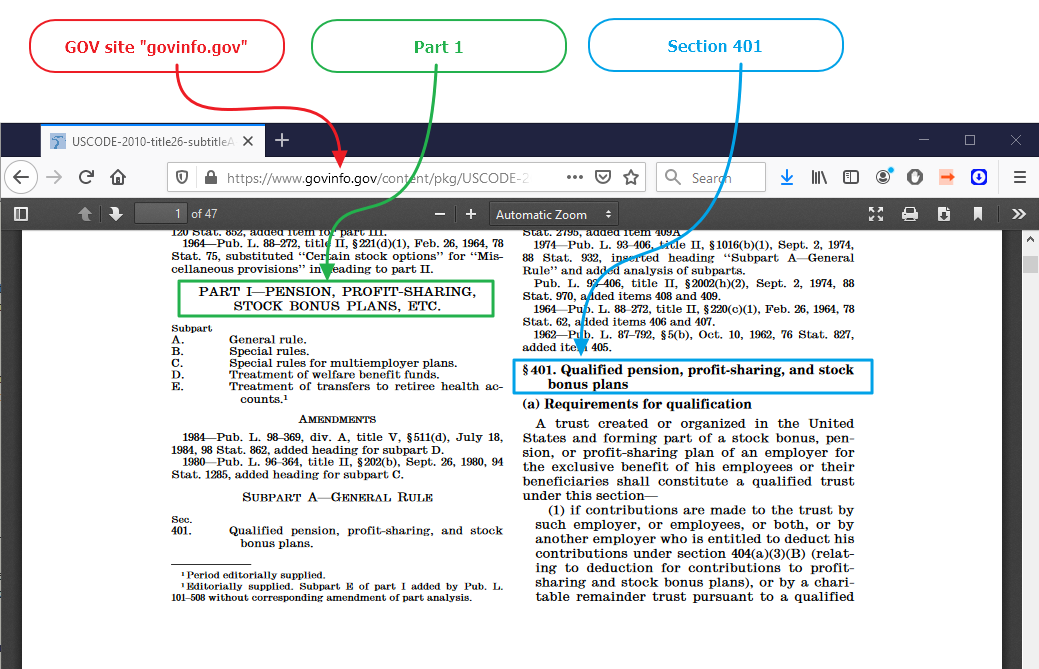

United States Congress codifed the Law about the 401(k) Plan under the US Code 2010, Title 26.

Oh yes ... and in case you're wondering about the peculiar sounding name for this retirement plan 401(k)

... Well then, the origin for this peculiar name is there in the way the law is written !!

Title 26

+-- Subtitle A

+-- Chapter 1

+-- Subchapter D

+-- Part 1

+-- Subpart A

+-- Section 401

+-- Paragraph K

Hence the name of the retirement plan is 401(k) *smile* This retirement plan, literally, is named after the Section and Paragraph of the law !!

The URL is https://www.govinfo.gov/content/pkg/USCODE-2010-title26/pdf/USCODE-2010-title26-subtitleA-chap1-subchapD-partI-subpartA-sec401.pdf

The Evolution:

The acceptance of the 401(k) plans was rather slow. Many employers were hesitant to offer these plans. And many employees were reluctant to participate. Often times the lack of knowledge of part of the employers and the employees was the factor. Many employers were unable to explain the facts about the 401(k) plans, and many employees had hard time understanding these plans. Often times there were few persistent questions -

- Will it be hard for me to get back my money when I leave the employer?

Answer is that NO ... it' not at all hard. It's a straightforward "rollover" process. Sure ... there's a bit of paperwork, but it's not hard.

- Why should I contribute to Employer's Plan?

Answer is that ... the plan is not Employer's, rather it is sponsored by the employer, governed by the law, enforced by ERISA, and vested money is owned by the employee. (And the 100% contribution made by employee is vested from day 1.)

Earlier, the employer's used to offer plan choices that had very high fees, and very long 'early-redemption-fees-periods'. Slowly it changed. The mutual funds, in general, that had high fees, and long early-redeption-fees periods started becoming extinct. The broker Charles Schwab was primarily responsible for this big change. Schwab revolutionized the mutual fund industry by offering a 'one-stop-marketplace' for mutual funds.

Keeping up with the changes, the 401(k) plans started offering more and more choices of mutual funds in the plan, with less and less fees, and less and less restrictions about trading. These days it's quite common to see many funds offered that have hardly any restrictions on the number of times in a year one can make exchanges, and hardly any restrictions about the "holding-periods".

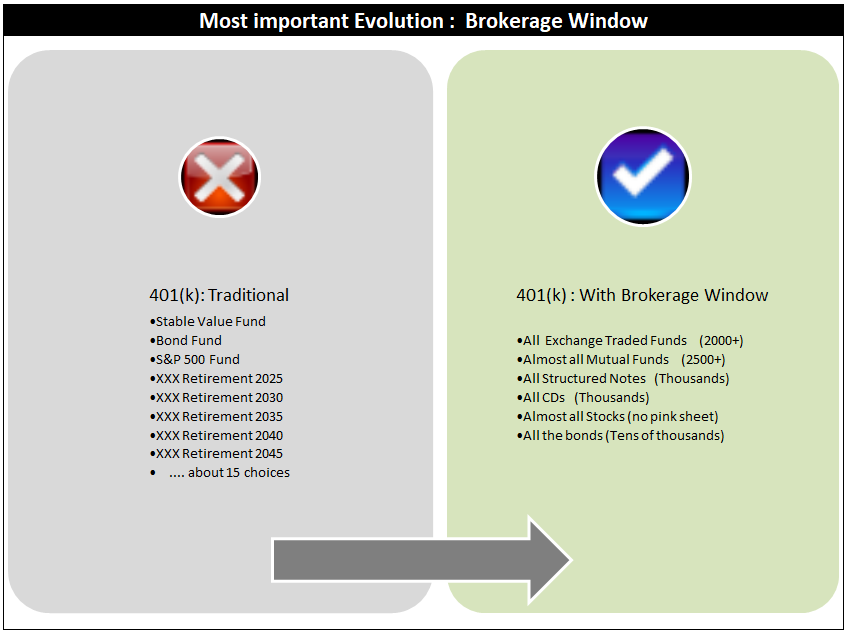

Next came the important evolution of offering what is called as the Brokerage Window.

The brokerage window started offering the accouts that are quite similar to the regular "cash" brokerage accounts (not "margin" accounts). Typically in traditional 401(k) accounts the choices are limited. Almost always there is a fund that's a 'stable value' fund, then there is bond fund, and a stock fund, and whole host of funds with names like 'xxx Retirement 2025, xxx Retirement 2030, xxx Retirement 2035' etc. These are supposed to offer the so called 'asset allocation' and the so called 'diversification'. (Both of these concenpts are from MPT - the 'modern portfolio theory' - which I do not believe-in at all.)

The brokerage window offers a vast array of choices for the savvy trader. The brokers "Fidelity" and broker "Charles Schwab" both offer the 'Brokerage Window' chocies. However, the plan sponsor (your emploer) needs to make this available in the plan. This is what I find of great benefit. It allows me to trade what I want, when I want, how many ever times that I want. (One cannot have margin on these accounts, and neither can one do short-selling, but otherwise almost everything one can trade in tradition "cash" brokerage accout, can be traded in these types of "brokerage window" accounts.) These account are known by different names:

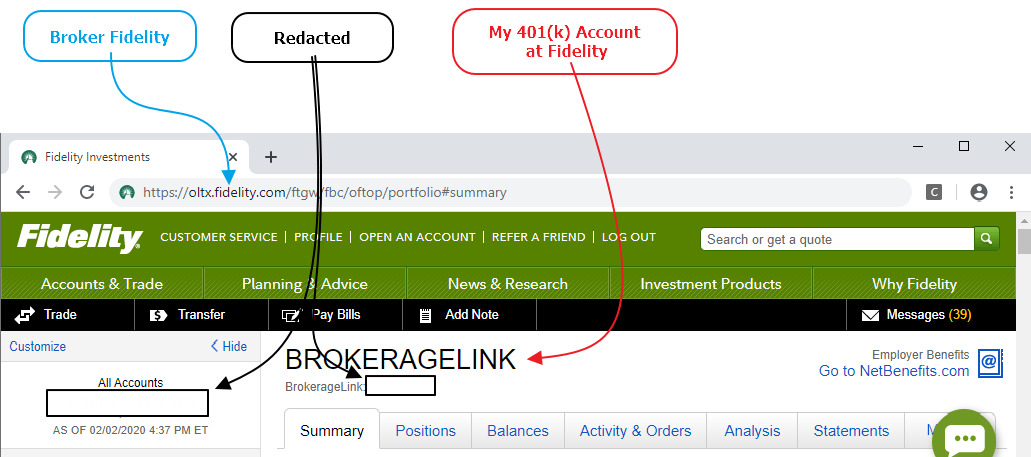

- Fidelity offers these accounts under the name 'Brokerage-Link-Account'.

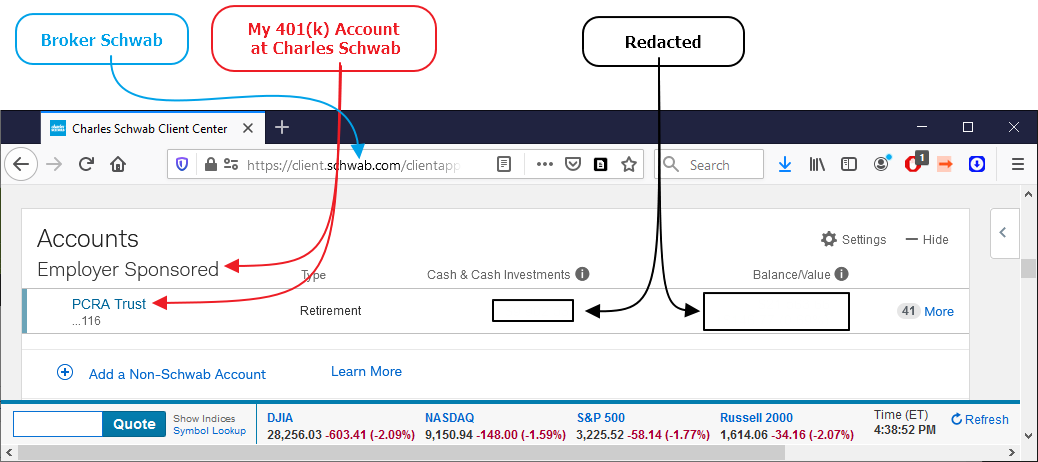

- Charles Schwab offers these accounts under the name 'Personal-Care-Retirement-Account'.

Personal Experience:

For more than a decade I've had experience of using the Brokerage-Link and PCRA accounts offered by Fidelity, and Schwab respectively, and my experience has been nothing short of spectacular.

I trade ETFs, and Mutual Funds rapidly using these accounts. I employ the three algos I've developed Wave Trading,  , and , and  in these accounts. in these accounts.

Following are the screen-grabs that show PCRA and Brokerage-Link accounts. (Of course I've redacted the material such as account#, amounts etc.)

PCRA @ Schwab:

Brokerage Link @ Fidelity:

What's next?:

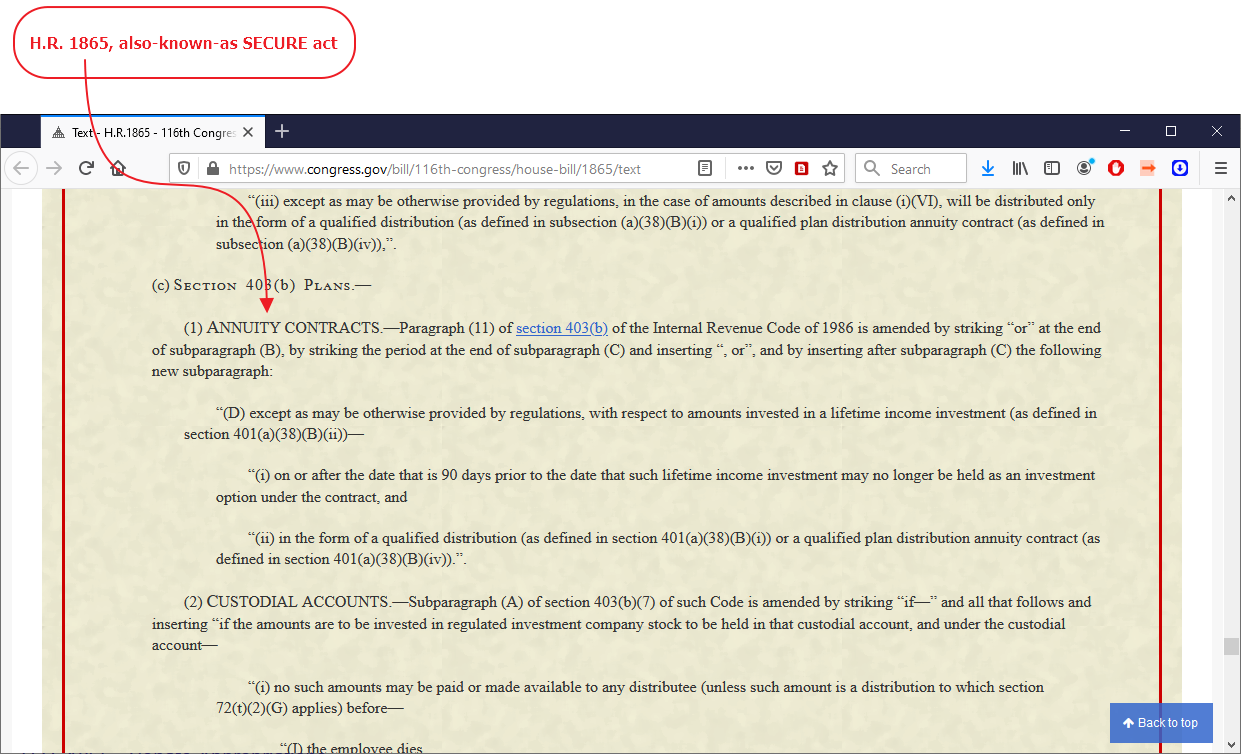

On December 20, 2019, Donald J. Trump, the President of the United States, signed H.R. 1865 into Law. This House Resolution 1865 is also called by the name of SECURE Act.

This law strikes out the provision, whereby the Annuity Contractrs were not to be offered under the 401(k) Plan. This means that from 2020 onwards it is possible for 401(k) sponsors to start offering Annuities within the 401(k) Accounts. So the evolution of the 401(k) plan is continuing. Let's see where it's going next ....

|