Profit making trading systems:

The most simplistic objective, for every trading system with the intent of profit making, is to buy low sell high. (There are some trading systems where the intent isn't profit making, rather it's 'tax-loss harvesting'. For such systems the simplistic objective does not apply.) Tactics to achieve 'buy-low-sell-high' in a cosistent manner involves using sophisticated algorithms, and implementing these in automated / semi-automated ways.

The algorithms that give consistent overall profits in all market conditions - during recession and expansion - in bull market and in bear market - during periods of inflation/deflation/stagflation are esential for a successful trader. To achieve this, I've designed sophisticated trading systems. (a) Fluctuation Trading (b) Wave Trading (c) Blitz Trading.

All of these systems are my 'original' work. I retain the copyright of this intellectual property, however, I am permitting others to make use of the algorithms. For my original work, I've coined terms for each of these trading systems.

I've alluded to this  in the web-page in the web-page  . .

Fluctuation Trading:

I've designed this system for trading Mutual Funds. This system is ideally suited where:

(a) Broker offers scheduling of Periodic Purchases of Mutual Funds and

(b) Broker allows unlimited trading of Mutual Funds without any commission/trading-fees/penalty/holding-period.

This system tends to have a large number of trades in a year. Typically this system has lower number of trades than the Blitz Trading. Because of large number of trades per year I use this sysem for tax deferred accounts (e.g. IRA, 401(k), Rollover IRA). I use brokers such as ProFunds, Guggenheim (formerly Rydex), Nationwide (formerly Jefferson National) for Fluctuation Trading. (Using this system at broker which has high commissions, long holding periods. high trading fees, could be detrimental.)

Employing this system for taxable account is of course doable, however the Form 1099-B in case of large number of trade in a year will be long. Entering these trades in Schedule D, and tracking the 'wash' sales, if any, will be an onerous task. Therefore, I use this system only in my E*Trade Brokerage for taxable account (I started using Fidelity Brokerage in 2020). I've signed-up for eDelivery of all trade-confirmation letters from my brokers, otherwise USPS delivery of vast number of trade confirmations letters would fill-up my mail-box.

Fluctuation Trading depends upon the  of market flctuations - which John Pierpont Morgan (1837-1913) famously observed. of market flctuations - which John Pierpont Morgan (1837-1913) famously observed.

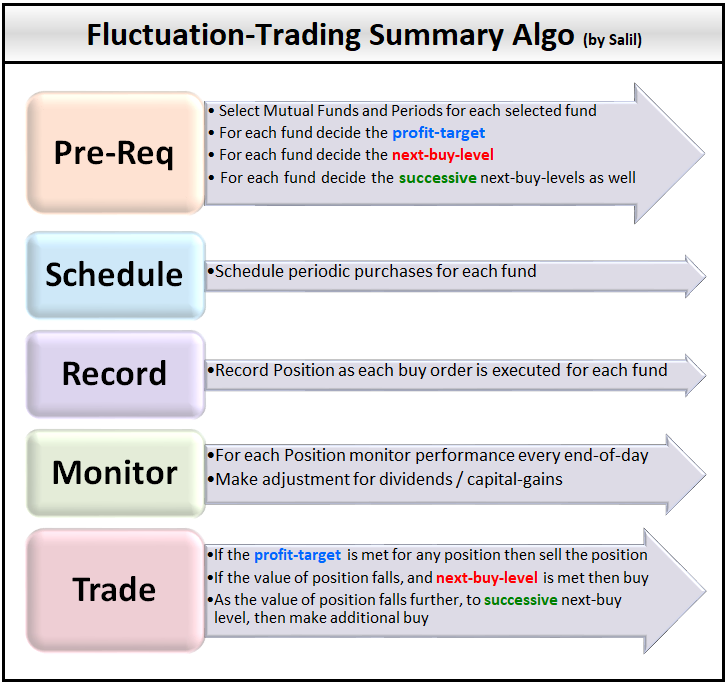

Fluctuation Trading Algo:

Summary

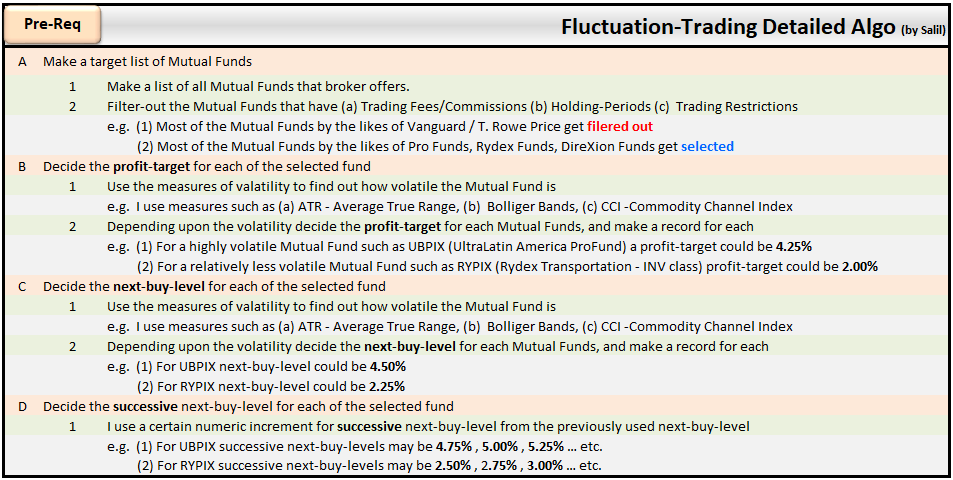

Detail - Pre-Req

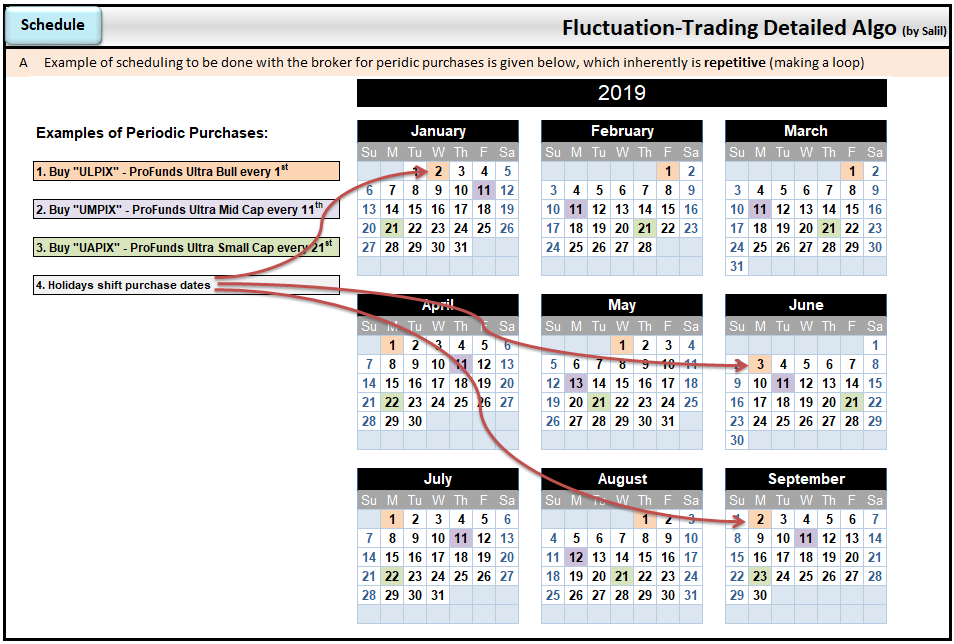

Detail - Schedule

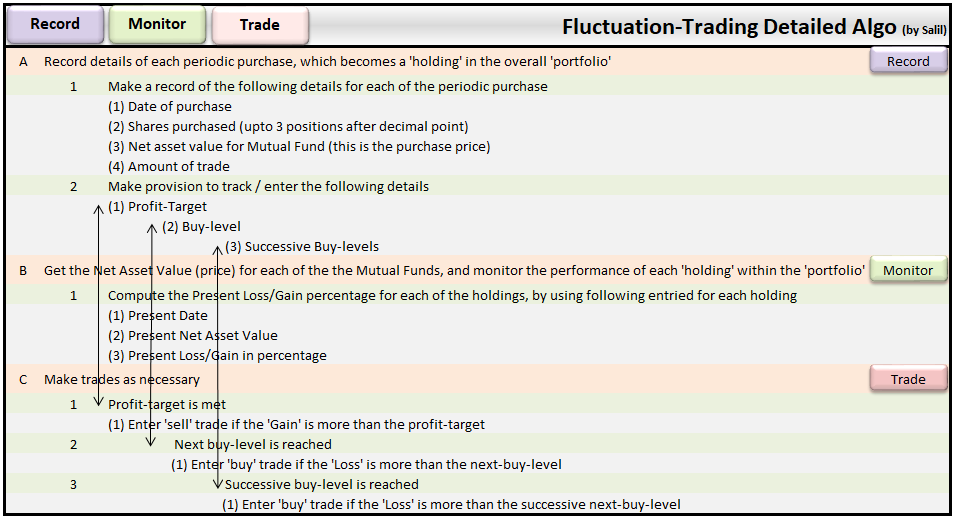

Detail - Record, Monitor, Trade

Some of my 'real-life' schedules:

Some of my schedules for different brokerage accounts are given below. These are some of the trades that make in real-life every month.

I've not given the schedules for my accounts at ProFunds and E*Trade. Those are too numerous. ProFunds does not have any restrictions at all on the per-trade amount (At E*Trade it's $100). I can purchase/redeem at whatever amount that's suitable for me. Also, at ProFunds/E*Trade there are no restrictions on how many "round-trips" I may make in a year. In theory, (say) I can purchase a mutual fund at ProFunds/E*Trade on Monday, redeem it on Tuesday, purchase it again on Wednesday and redeem it on Thursday, then purchase it once again on Friday and redeem it on Monday, and keep doing this sort of purchase/redemption pattern without any restriction/objection whatsoever from ProFunds/E*Trade.

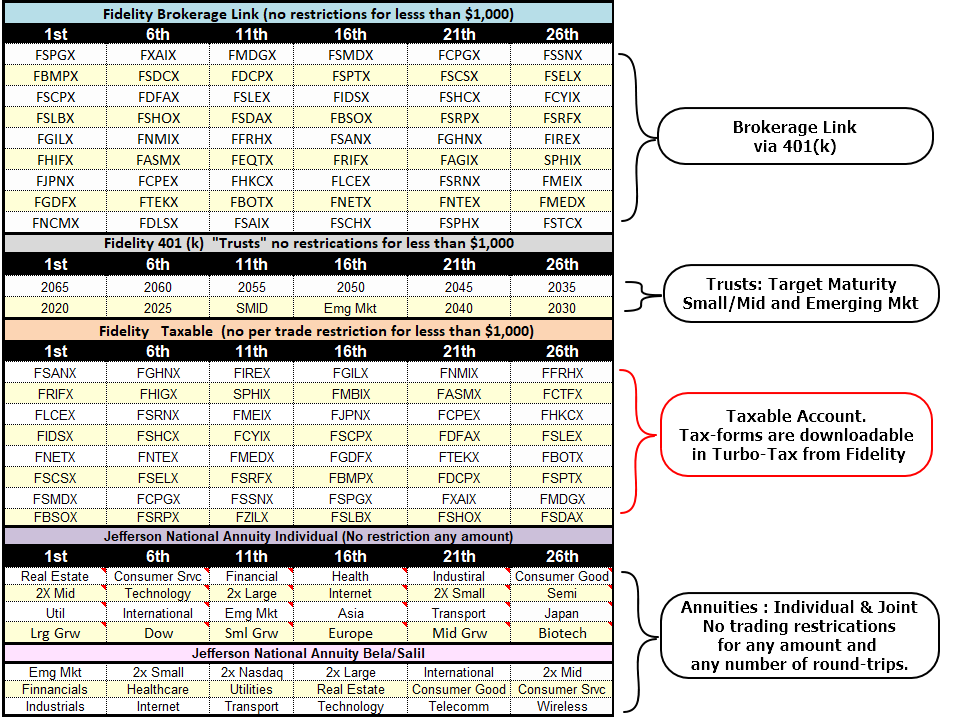

Normally Fidelity brokerage charges $49.99 fees for all the mutual fund trades where the redeption is made within 90 days of purchase, however Fidelity Brokerage has an exemption of this fees, when the mutual fund traded is by Fidelity itself, and when the amount of purchase which is redeemed subsequently, is less than $1,000. This exception makes all of the mutual funds by Fidelity ideally suited for rapid trading, so long as I keep the purchase amount per mutual fund, per day, less than $1,000. The screen-grab I've given below of my Excel Workbook shows how I utilize the exception by using a large number of mutual funds by Fidelity itself, at the brokerage by Fidelity. All of these are in Brokerage-Link which is associated with 401(k) account, therefore there is no per-year tax-reporting necessary. (Click here to read about the 'Evolution of 401(k) where I've described the details of Brokerage Link.)

I am tired of getting zero or near zero returns in the FDIC insured accounts, therefore in 2020 I started trading mutual funds even in Taxable account at Fidelity Brokerage. (Yes, for FDIC insured accounts the loss of principal is quite small, and opposite is the case when Trading. However I've decided to take that risk.) The 'basis' I've selected in my account is the 'average cost basis' as described by IRS in Publication 550. A few years ago I had used 'specific share identification' method, but this time I am using 'average cost' basis. An additional factor that needs to be considered are the Wash Sales. This is an onerous task if I were to do this manually, therefore I've built logic to track these automatically.

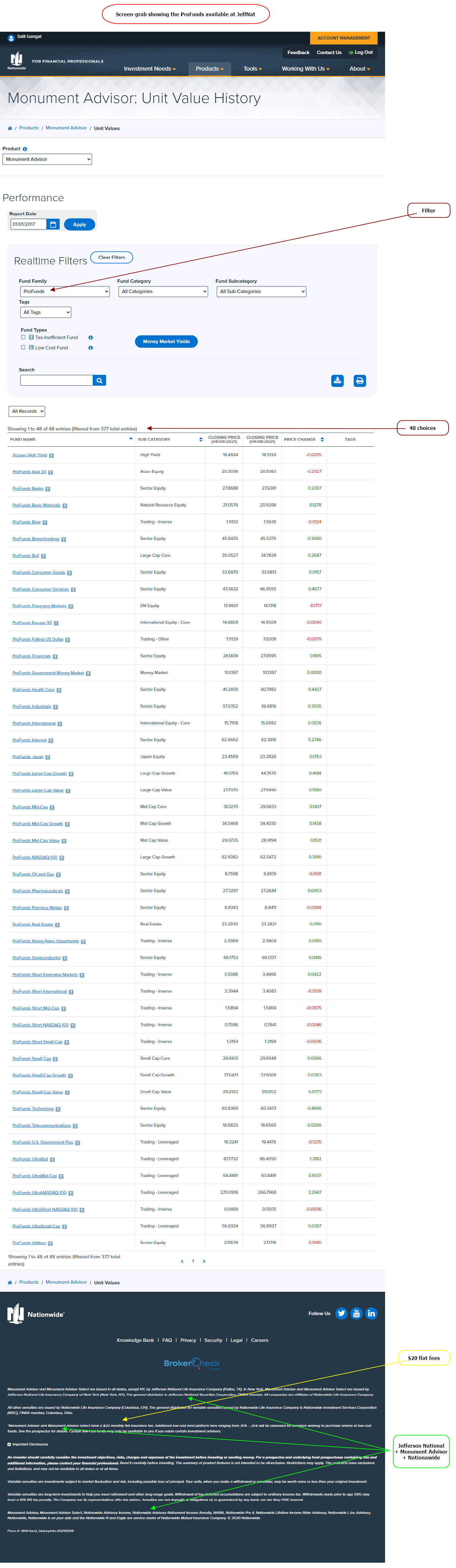

I use Variable Annuities managed by Jefferson National (JeffNat was purchased by Nationawide). These variable Annuity have almost all of the ProFunds and RydexFunds in Variable-Annuity format. Just like ProFunds/E*Trade, there are no amount-per-trade and number-of-trades-in-a-year restricions at JeffNat. (Click here to get Excel Workbook showing comparison of the Variable Annuities I made, that are suitable for Trading, and Click here and scroll down to 'Guarantee offered by Insurance Companies for Fixed Annuities', to read about the shortcomings/risks I see for the 'Fixed Annutieis'. To be clear, the Annuity I use is 'Variable Annuity', not a Fixed Annuity.)

The number of trades per month shown below are only on purchase-side, which are 26 rows X 6 days = 156 trades per month. (Per year 156 X 12 = 1872 purchase trades). The purchase dates are 1st, 6th, 11th, 16th, 21st, and 26th which go over to next business day if these days are trading-holidays. Potentially each purchase trade has a matching redemption trade, which means per year on an average there are 3744 total trades (which are listed below - and there are other scheduled that are not listed below!). There of course are many more in addition the "scheduled" which are generated by of 'next-buy-level' and 'successive-buy-levels' (Step C2, Step C3 of algo above). This ought to given an idea about what's involved, and perhaps the potential of this algo that's based on 'certainly' in the financial markets. (For the sake of creating scenario imagine that each trade is just for $100, and profit on each trade is just 3% which is $3, then this algo would result into profit of $5,616 per year. It's easy to create 'what If' types of calculaions in Excel to expand on this - 'what if' every trade is $200, $300 etc. 'what if' the profit per trade is 4%, 5% etc. 'what if' more mutual funds' trades are made than present 156 etc.)

(The vastness of number of trades naturally has made me sign-up for eDelivery for Trade Confirmation, and Monthly Statements, else my USPS mailbox will get clogged up. *smile* ... Yes, from time to time some of my monthly brokerage account statements run into 100s of pages.)

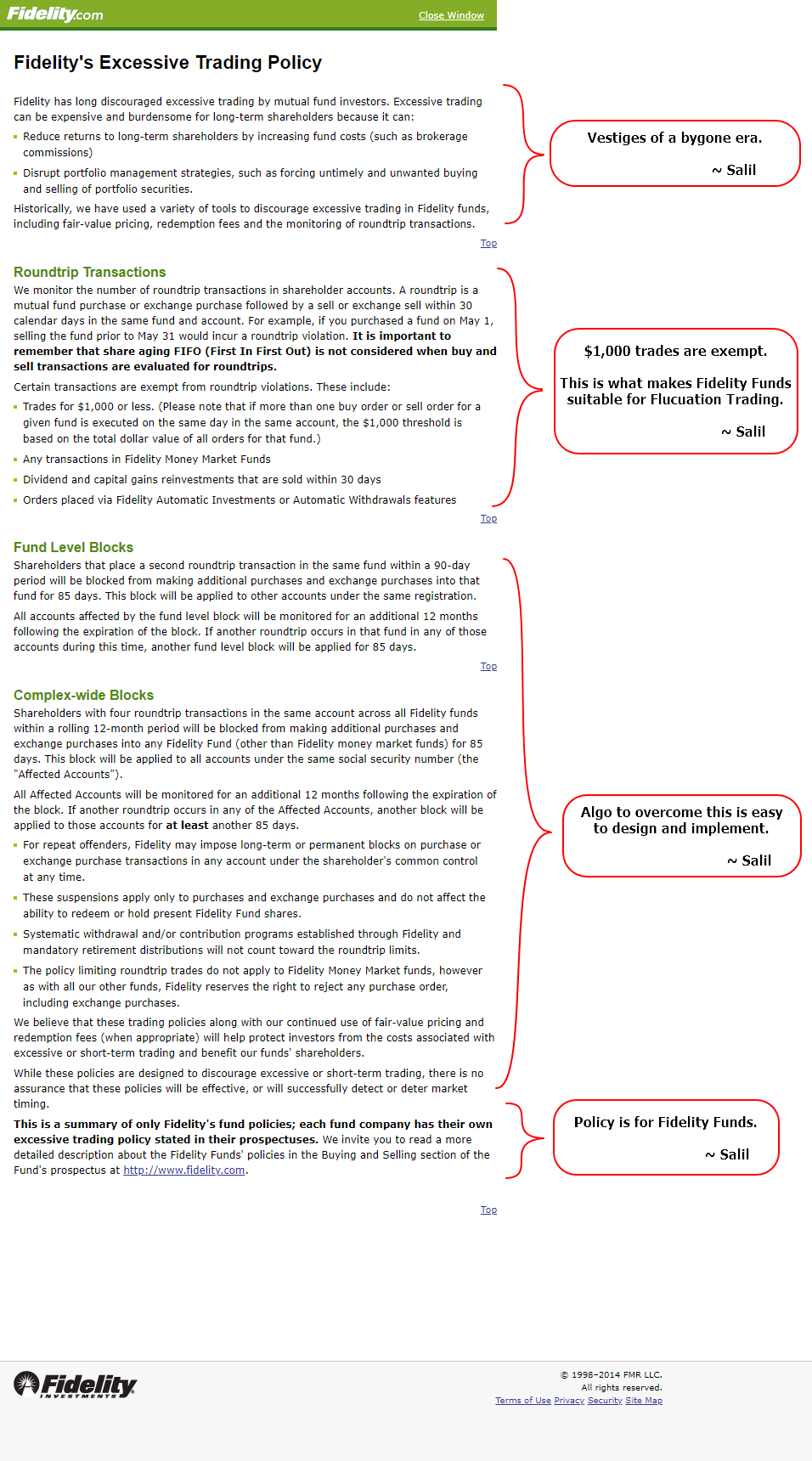

Fidelity Excessive Trading Policy for Mutual Funds:

Fidelity has published their Policy that's applicable for what they consider as excessive trading.

In my opinion, the excessive trading of mutual funds ought not to hurt anyone, unless trade size is in massive amounts. Amounts that would form a significant percentage of the overall assets of a mutual fund - which typically would be a trade size that's in millions of dollars per trade. No matter what my opinion - I've analyzed the published policy of Fidelity, and I've designed algo to work within it. This policy is one of the reasons, why I select lots of mutual funds by Fidelity to trade using Fidelity Brokerage. Trading lots of funds simltaneously allows me to stay under $1,000 per trade, yet make the overall trade-size in larger amounts, so as to make the effort a worthwihle effort.

The per year contribution amounts in 401(k), by law, are capped to small amounts. So, for the 401(k) plans where service provider is Fidelity, its easy to trade only a few Fidelity Funds, as the trade size inherently cannot be large !! (e.g. For current tax year 2015 the contribution amount is capped at $18,000 only.)

Choices available at JeffNat:

There are plenty of choices available for rapid trading in my Annuity at Jefferson National.

The names used in the context of the policy are many. I tend to refer to this as my Annuity policy at Jefferson National (JeffNat) because the firm I dealt with when I opened the Annuity Policy was Jefferson National. Within this, the Policy was managed by Monument Advisor, and subsequently Jefferson National was purchased by Nationwide *smile* therefore all of these various names are applicable for my Annuity Policy !! The details towards the bottom of the screen-grab allude to various names.

JeffNat charges mere $20 per month, that allows me to do limitless trading of Mutual Funds offered by ProFunds and Guggenheim !! This fees is disclosed in the text at the bottom of the screen-grab as well.

I've dealt with JeffNat for years, and I've developed working-relationship with the personnel at JeffNat - pretty much like what I have at TD Ameritrade, for Structured Notes. FINRA Rule 3220 is applicable for monetary gifts, therefore rather than involving any money, I make it a point to send 'Thank You' cards to the personnel at Broker who take my orders. (Quite frankly, I make enough profits that I'd to glad to send a few StarBucks or Amazon gift-cards to different personnel at Broker. *smile*)

The price of regular mutual fund (also known as the NAV - net-asset-value) is always expressed with precision of 3 decimal digits after the decimal point. The price (also known as 'unit value') for VA (variable annuity) versions of the mutual funds is always expressed with higher precision - it goes upto 4 digits after the decimal point which is what is shown in the screen-grabs below.

I trade using both the Long and the Short funds, and using both the Leveraged and non-Leveraged funds. (Shorting is generally more risky. I handle the additional risk by setting the limits using ATR, CCI signals differently.)

ProFunds @ JeffNat

Guggenheim (Rydex) Funds @ JeffNat

Posts on Linked-in giving 'live' examples of Algo in action:

8/7/2021 and 8/10/2021 Post and Follow-up where 'Fluctuation Algo' generated 15% profit within 10 days.

|